| Online: | |

| Visits: | |

| Stories: |

The Greatest Wealth Transfer Never to Take Place (VIDEO)

The Greatest Wealth Transfer Never to Take Place

Originally posted on RaptormanReports

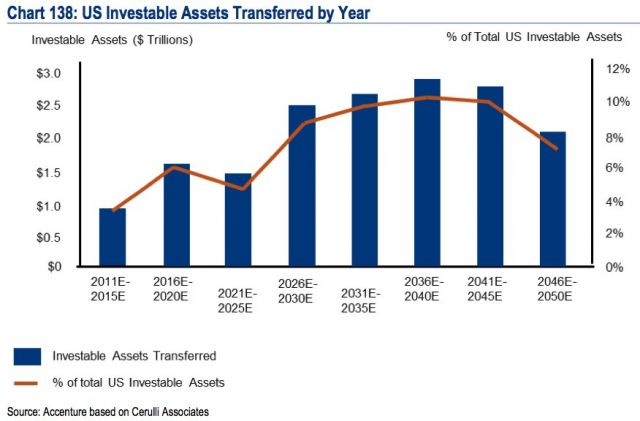

Within the next 30-40 years the greatest transfer of wealth ever to occur in human history will be unfolding as the older generations all around the world begin to transfer their wealth as they retire and pass on. In the United States alone an estimated 30-40 trillion dollars is be transferred to the heirs of the baby boomer’s according to Bank of America’s Sarbjit Nahal and Beijia Ma. This only represents the assets of average to moderately successful people, not the billionaires who can hide their money well. Let’s talk a 401k or pension and a house or two, not mansions and yachts.

Globally this number is much higher with estimates from 40-70 trillion dollars to transferred to the subsequent generations through legal means. Never before in history has so much wealth been accumulated and living standards been so high, for the average person, as they have been in the late 20th and early 21st century. This is only a projection and represents the total accumulated wealth that will be looted by the global elite in the next series of financial meltdowns. It will be the purpose of this article to take a look at a few key pieces if information and to ask a question. You didn’t think you were actually gonna keep that wealth did you? Let’s examine how this will be done and why.

Aged population retiring at the same time along with lower birth rate means means most retirement liabilities are completely insolvent going into the future as all metrics show. Unemployment by robot replacement to play significant factor. Who will fund these liabilities?

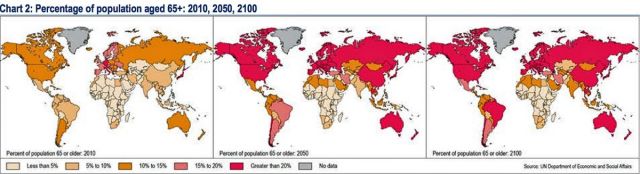

The number of people over the age of 60 is expected to double from 841 million in 2013, to over 2 billion by 2050, according to the UN. What’s more this has been accompanied by falling global birth rates.

In fact, the global share of people over the age of 60 has gone from 9.2% in 1990, to 11.7% in 2013 and is expected to hit 21.1% in 2050, according to Bank of America’s Sarbjit Nahal and Beijia Ma. The number of people over the age of 60 (older persons) is set to exceed the number of children for the first time, by 2047.

“Longevity risk is hugely underestimated,” the write. “Longevity risk will be one of the most significant challenges facing retirement systems over the next 50Y, with global annuity and pension-related exposure estimated to be as high as US$15-25tn.”

The program to rob you and your family is well under way as anyone that has ever earned a dollar is well aware of. Beyond taxes, government debt, monetary manipulation, fees, regulations and other garden variety schemes we live with now, the plans in store will be much worse. We are seeing the beginning of a post consumer society where government and corporations will reach directly into your account for the basic needs to survive. No more cheap crap made in China to fill the empty soul just more plans like Obamacare to way over charge for basic necessities. You will be paying more for less. The backbone of this is a cashless society that will allow complete control of economies and people. As well as negative interest rates, more bank bail outs, bank bail ins(sorry can’t take your money out), replacing your pension or 401k with worthless government bonds and of course the derivative bubble(created by banks) governments around the world have signed their people on to pay for.

I don’t know anyone younger than 40 that actually expects to have Social Security when they retire but what most don’t expect is that almost all wealth will eventually be taken except for the people at the very top. So we have an aging population owed a lot of money that won’t be there, younger generations that won’t have jobs because robots have replaced them and global governments that need to keep a lid on the whole situation. It’s gonna be a shit sandwich and the more bread you got the less shit you gotta eat.