| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Fed debates approach as inflation fears grow

|

| Officer guards the Federal Reserve building © AFP/Getty Images/File Brendan Hoffman |

WASHINGTON (AFP) – A fight looms Tuesday in the US Federal Reserve as policy makers wrestle over whether the threat of inflation should prevent them from feeding more money into the economy to boost jobs.

While one camp on the Federal Open Market Committee is believed to favor a hopefully stimulative economic measure known as “Operation Twist,” a group of vocal dissenters could block that, shouting the alarm that inflation is picking up.

Until data released on Thursday showed a surge in inflation, markets and economists had mostly expected that the FOMC would adopt Operation Twist — a 1961 bond-buying tactic named after the popular rock and roll dance of the time.

But with consumer prices having surged significantly in July and August, and the inflation rate now at 3.8 percent year-over-year, analysts say the so-called inflation hawks might have power behind their argument that more stimulus would be dangerous.

The August inflation report “makes a mockery of the FOMC’s claim that inflation has moderated in recent months and raises the hurdle for additional easing action,” John Ryding and Conrad DeQuadros of RDQ Economics said in a report.

Already anticipating a tough debate, the FOMC decided last month to extend the meeting to two days to weigh the evidence and the choices.

At the end of June the Fed wound up its “QE2″ stimulus measure, a six-month program to inject $600 billion of liquidity into the economy by buying short-term US bonds.

QE2 — the second round of “quantitative easing” — prevented a plunge into disinflation. But it failed to give a sustained boost to the overall economy, which grew at a near-stall rate of below one percent in the first half of the year, leaving the jobless rate at more than nine percent.

Since then, Fed chairman Ben Bernanke has consistently said that unemployment, and the lack of confidence that is preventing consumers from spending money, is the US economy’s biggest problem.

With worries of recession resurfacing, at its last meeting on August 9 the FOMC decided to make a pledge to hold interest rates near zero for two more years.

|

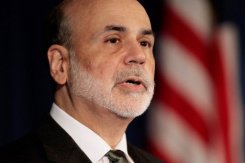

| Federal Reserve Chairman Ben Bernanke © AFP/Getty Images/File Chip Somodevilla |

It was an uncommon public commitment designed to encourage long-term, job-generating lending by banks and investment by companies skittishly hoarding cash.

The Fed, however, did not offer a successor to QE2, and weeks later the minutes of that meeting showed that three of the FOMC’s 10 voting members — the inflation hawks — were strongly against the pledge on interest rates.

But with the government increasingly concerned about slow growth and joblessness — and critics pointing out that promoting employment is a central Fed mission — in succeeding weeks Bernanke declared the Fed was ready to take new action to speed up the economy.

“The Federal Reserve has a range of tools that could be used to provide additional monetary stimulus,” he said on September 8.

The pickup in inflation could make the FOMC more cautious, however.

A key issue is that the surge has mainly come from often volatile food and fuel prices.

The Fed prefers to focus on “core inflation” which does not include food and fuel, and that figure has also risen, to a year-on-year rate of 2.0 percent in August.

Operation Twist could be an acceptable compromise. The Fed is still holding and rolling over the QE2 purchases of short-term bonds. It could shift these holdings to long-term bonds, a move that would press down long-term rates, to further encourage bank lending to companies and corporate investment.

Another possibility is to reduce to zero the interest the Fed pays on the excess reserves commercial banks deposit with it — another incentive for them to lend it out to higher-paying private borrowers, whether companies or homeowners seeking to refinance to lower their mortgage costs.

“The Twist is the least dull tool in the box,” said economist Chris Low of FTN Financial.

© AFP — Published at Activist Post with license

Source: