| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Joseph W. Martin Jr., “The Patients Are In Charge of the Asylum”

by Joseph W. Martin Jr.

“The announcement coming out of the G20 meeting in Mexico that the EU countries are now going to pony up another €600 billion ($750 billion) to further bail out Spain and Italy clearly shows that the inmates are in charge of the asylum. Just a month ago we were told that Spain did not need a bail out but now they are to be given €100 billion to re-capitalize their banks.

So just where is this €600 billion going to come from? According to the press release the largest part is to com from the ESM (European Stability Mechanism), problem is that the German Bundestag has not yet authorized Germany’s participation in the ESM. The primary reason it has not done so is that the German voting public has repeatedly (in local elections) that they have had enough of bailing out the profligate PIIGS. If the structure of the so-called agreement is anything like the €100 billion bailout of Spain it will obligate the already bankrupt to loan to the already bankrupt at rates below that which they will in turn have to borrow the funds.

Lets be honest here: the only winners here (and that only short term, very short term) will be the banks facilitating the loans. So what is the financial reality behind this latest of stopgap measures? Quite simply it’s the CDS derivatives (Credit Default Swaps) that would come due if the Spanish and Italian banks went belly up (never mind Greece, Ireland and Portugal). Safe to say there isn’t enough money in the world to cover the loss. What is known is that large U.S. banks have underwritten these policies and would be bankrupted quite literally overnight if they were called to pay up.

Never mind the danger presented by Greece leaving the Euro zone, once the German voters and taxpayers are presented with this €600 billion bill they may well say enough is enough and leave the Euro themselves. What, the Germans behave like nationalists? Yeah right, like that has never happened before.

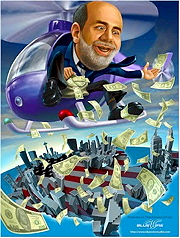

Rest assured the politicians and bankers are scared to death of the Frankenstein’s monster that they have created. Rest assured as well that none of them will have the courage to address the issue in public. The FED and the ECB are going to have to put the printing presses into over drive whether they want to or not. They were of course were hoping to put any such action off until after the U.S. elections, but reality is moving too fast for them to keep playing the propaganda game for that long. Hope for the best but prepare for the worst, things are going to get ugly long before November 6th.”

Source: