| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

Ben Bernanke to face US senate questioning over Barclays fallout

Wednesday, July 11, 2012 11:08

% of readers think this story is Fact. Add your two cents.

Guardian

Dominic Rushe

Dominic Rushe

Libor interest rate manipulation may have been known to Federal Reserve and other US regulators in 2007

|

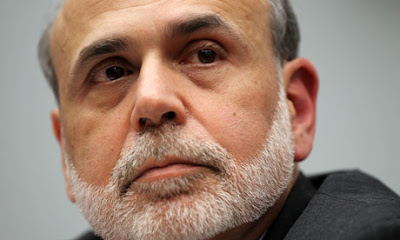

| Ben Bernanke will be quizzed about his response to a scandal that has so far led to the ousting of Barclays’ top three executives. |

Federal Reserve chairman Ben Bernanke is set to be quizzed about the failure of US regulators to stop bankers manipulating interest rates as the fallout of the Barclays Bank scandal spreads to the US.

Senator Tim Johnson, the chairman of the banking committee, said Tuesday that Bernanke should be prepared to discuss the possible illegal manipulation of the London Interbank Offered Rate, or Libor, by banks in Europe, Japan and the US when he appears before the panel later this month. Johnson said treasury secretary Timothy Geithnerwould also face senators’ questions on the scandal at a separate hearing.

“I am concerned by the growing allegations of potential widespread manipulation of Libor and similar interbank rates by some financial firms,” said Johnson. “At my direction, the committee staff has begun to schedule bipartisan briefings with relevant parties to learn more about these allegations and related enforcement actions.”

US regulators are coming under fire after revelations that they may have known about flaws in setting interest rates as early as 2007 when the Federal Reserve bank of New York shared its concerns about possible manipulation of Libor with UK regulators.

Libor rates are ultimately used to set rates for anything from car loans to mortgages and other securities in a market valued at $550tn. Regulators are investigating whether bankers colluded to manipulate Libor in order to make profits or avoided losses by wagering on the direction of interest rates.

Barclays last month agreed to pay $453m to British and US authorities to settle allegations that it manipulated Libor. More than a dozen other banks including Citigroup, HSBC and JP Morgan Chase are being investigated for their roles in setting Libor rates.

The scandal has so far led to the ousting of Barclays’ top three executives and caused a political firestorm in the UK.

New York Fed officials quizzed executives at Barclays in 2007. The bank has considerable operations in the US and bought the core assets of bankrupt Lehman Brothers bank in 2008.

Geithner, former New York Fed president, even held a meeting on April 28 2008 titled “Fixing Libor” that was attended by other Fed officials.

In a statement a New York Fed spokesman said: “In the spring of 2008, following the failure of Bear Stearns and shortly before the first media report on the subject, we made further inquiry of Barclays as to how Libor submissions were being conducted. We subsequently shared our analysis and suggestions for reform of Libor with the relevant authorities in the UK.”

Darrell Duffie, a Stanford University finance professor and Libor expert, said he expected more banks to be fined as the full extent of the scandal emerges. “At present we just don’t know whether Barclays was fined first because it was the most egregious case or because it was the most co-operative,” he said.

Duffie said he expected regulators on both sides of the Atlantic to face mounting criticism. “Collectively the regulatory community didn’t push as hard as it should have on this issue even though they have clearly been following it from the beginning,” he said.

Help Us Transmit This Story

The

Intercept is a collection and transmission of data that offers

substantive contradictions, challenges and enlightenment over the

conventional drivel brought to us by corporate media.

Source: