| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

On Social Security

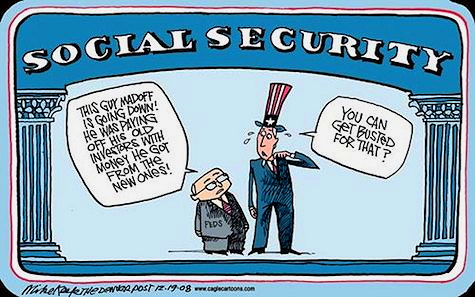

“The fraud of social security is becoming apparent to all but the truly economic illiterate. Young people, by overwhelming margins, don’t expect to collect anything from social security upon retirement. Most understand that the Ponzi scheme will collapse long before they retire. When the Associated Press understands something, it shouldn’t be too hard for the rest of us to comprehend. Arnold Ahlert points out that even they may be catching on: “People retiring today are part of the first generation of workers who have paid more in Social Security taxes during their careers than they will receive in benefits after they retire. It’s a historic shift that will only get worse for future retirees, according to an analysis by The Associated Press.”

Mr. Ahlert points out the critical myth surrounding the Ponzi Scheme we know as Social Security: “One of the most successful bits of propagandizing by leftists has been their ability to convince a majority of Americans that they are better off sending their Social Security payments to that giant federal sinkhole Washington, D.C., instead of putting them into a private account with their own name on it. In terms of propaganda coupled with economic illiteracy, it doesn’t get any better than that.”

How dumb can the electorate be to continue to put up with the Social Security fraud? [No comment!- CP] At some point, there is likely to be intergenerational strife. Why should young people augment the lifestyles of the elderly whose net worth dwarfs that of young families with needs? When social security could be sold as an “investment” that would pay back more than you put in, it was easy to sell. Now that is no longer the case. On what principle is it better to give your money to the government so that they can (perhaps) return a smaller portion of it to you sometime in the future? Given that fact, why should young people continue to contribute even if they believe the program will be there for them?

Anyone dying before retirement loses whatever has been contributed. Likewise, anyone dying after retirement but before they have reached the average life expectancy loses whatever is left. Wouldn’t it be better if heirs could inherit whatever was left in the deceased social security account? Surely, but that is not possible in a broken and grossly underfunded system.”

2012-08-11 12:44:01

Source: http://coyoteprime-runningcauseicantfly.blogspot.com/2012/08/on-social-security.html

Source: