| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

Imminent Global Tsunami:

http://investmentwatchblog.com

Imminent Global Tsunami: Euro Crisis To Worsen As Greece Could Exit euro And Nobody Wants The ECB Bailout, Canadian Housing Bubble Goes Into Full Mania Mode, China & Russia Sound Alarm on Global Economy And Fitch Lower Short Term Bonds

STOCKHOLM: The eurozone crisis will get worse before it gets better and Greece could exit the single currency bloc within a year, Swedish Finance MinisterAnders Borg said in an interview on Saturday.

“I don’t think we’ve seen the worst yet in countries like Spain and Greece. They have such serious problems that Europe is going to be in a very difficult position during the next six to 12 months,” Borg told public broadcaster Swedish Radio.

The Swedish finance minister, whose country is not a member of the eurozone, said he would not be surprised if Athens had to leave the 17-member eurobloc in the foreseeable future.

He stressed that while there was “much support” for the country in Europe, “we can’t rule out the possibility that Greece will end up in a situation where it in practice leaves the euro in six, nine or 12 months.”

Suddenly, Nobody In Europe Wants The ECB Bailout

It took the ECB a year of endless behind the scenes Machiavellian scheming to restart the SMP program (which was conceived by Jean-Claude Trichet in May 2010, concurrent with the first Greek bailout). The markets soared with euphoria that this time will be different, and that the program which is a masterclass in central planning paradox, as it is “unlimited” yet “sterilized”, while based on “conditions” none of which have been disclosed, and will somehow be pari passu for new bond purchases while it retains seniority for previous purchases of Greek and other PIGS bonds, will work – it won’t, and the third time will not be the charm as we showed before. Yet it has been just 48 hours since the “bailout” announcement and already Europe is being Europe: namely, it turns out that nobody wants the bailout.

On one hand there’s Germany for obvious reasons – not only are they footing the cost, but it is for them that the threat of an inflationary spike as a result of “unlimited” bond buys is most acute. But on the other, just as we predicted all along, are Spain and France, the biggest beneficiaries of the bailout, and whose bonds soared on expectations the ECB may buy them, who overnight have had a change of heart and say they never actually needed the bailout. Why? Because its politicians have suddenly had a change of heart and realize they will be sacked the second they hand over sovereignty over to the Troika or whatever supernational entity is in charge of the country following the submission of the bailout request.

More importantly, and as explained before, as long as the yield on the bonds of insolvent European countries is sub 8%, not one country will demand a bailout.

…

Italy Has No Plans to Access ECB Bond-Buying Plan: Monti

Italian Prime Minister Mario Monti said he is not expecting Italy to access the European Central Bank’s new bond-buying program anytime soon in an exclusive interview on CNBC’s “Closing Bell.”

China And Russia Sound Alarm on Global Economy

China sounded the alarm about the state of the global economy on Saturday and urged countries gathering at an Asia-Pacific summit to protect themselves by forging deeper regional economic ties.

Chinese President Hu Jintao said his country would play a role in helping deepen cooperation between the 21 members of the Asia-Pacific Economic Cooperation (APEC) by rebalancing its economy to improve the chances of a global economic recovery.

Russian President Vladimir Putin had also expressed concern about the world economy on Friday, and particularly about Europe’s debt crisis, as he prepared to host the annual APEC summit in the Pacific port city of Vladivostok.

“The world economy today is recovering slowly, and there are still some destabilising factors and uncertainties. The underlying impact of the international financial crisis is far from over,” Hu told businessmen in a speech before the summit.

BREAKING NEWS TODAY: CHINA INFLATION RISING QUICKLY AS ECONOMY SLOWS…….DOOM ON

SOROS: Germany should leave euro zone if not prepared to lead

(Reuters) - Germany should leave the euro zone if it is not prepared to take a more decisive lead in helping the euro zone’s weaker nations escape a spiral of increasing indebtedness and economic decline, veteran financier George Soros said on Saturday.

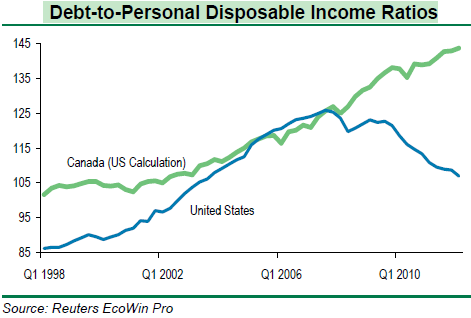

As global real estate bubbles burst at differing intervals, those still engaged in the depths of mania fever find every convenient argument to justify the existence of the current inflated economic structure. We can debate the nature of the current US housing market but with the median nationwide home price at $151,600 from the most recent Zillow housing report and the median household income at roughly $50,000 prices look to be leveling out especially with the absurdly low interest rates. As we know, housing markets are regional so applying this nationwide trough to frothy markets may not be the best way to measure investment value. However, when we look at the Canadian housing market we realize how insane things have gotten. I’m amazed by how many of the debt rehab or home flipping shows have migrated to the Canadian market. Of course they rarely mention this thinking the American audience will mindlessly assume they are in some other US city to prime the consumption pump. Yet when we look at the metrics, Canada is poised for a deep and profound correction.

…

…

Read More : investmentwatchblog.com

2012-09-10 01:42:17

Source: