| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

“Why You Should Prepare for Economic Catastrophe”; A Comment

“It is not often that readers get a clear-cut choice between two forecasts. Most forecasts have wiggle room. Not the following.

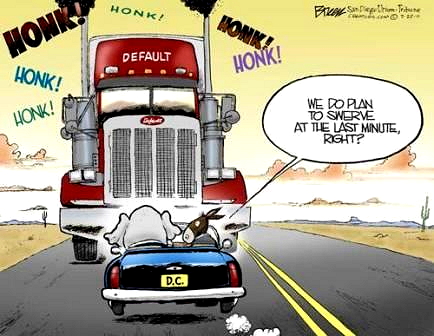

1. The United States government will default.

2. The United States government will not default.

I hold the first position. John T. Harvey holds the second. He wrote a piece for Forbes defending his position: “It Is Impossible For The US To Default“. I regard this as the most fundamental economic issue facing the U.S. government. I regard it as the most fundamental economic issue facing Americans under age 60.

Mr. Harvey begins: “With so many economic, political, and social problems facing us today, there is little point in focusing attention on something that is not one. The false fear of which I speak is the chance of US debt default. There is no need to speculate on what that likelihood is, I can give you the exact number: there is 0% chance that the US will be forced to default on the debt.”

That is the kind of forthrightness that I appreciate. Here is my response. With so many economic, political, and social problems facing us today, it is crucial that we focus attention on something that is both catastrophic and inescapable. The fear of which I speak is the chance of U.S. debt default. There is no need to speculate on what that likelihood is, I can give you the exact number: there is 100% chance that the U.S. will be forced to default on the debt.

UNFUNDED LIABILITIES: Why do I believe this? Because I believe in the analysis supplied by Professor Lawrence Kotlikoff of Boston University. Each year, he analyzes the statistics produced by the Congressional Budget Office on the present value – not future value – of the unfunded liabilities of the U.S. government. The latest figures are up by $11 trillion over the last year. The figure today is $222 trillion. This means that the government needs $222 trillion to invest in private capital markets that will pay about 5% per year for the next 75 years.

Problem: the world’s capital markets are just about $222 trillion. Then there are the unfunded liabilities of all other Western nations. These total at least what the U.S. does, and probably far more, since the welfare state’s promises are more comprehensive outside the USA.

Conclusion: they will all default.

Mr. Harvey thinks that the U.S. government could choose to default, but it won’t: “We could choose to do so, just as a person trapped in a warehouse full of food could choose to starve, but we could never be forced to. This is not a theory or conjecture, it is cold, hard fact. The reason the US could never be forced to default is that every single bit of the debt is owed in the currency that we and only we can issue: dollars. Unlike Greece, we don’t have to try to earn foreign exchange via exports or beg for better terms. There is simply no level of debt we could not repay with a keystroke.”

There are a lot of people inside the camp of the gold bugs who also believe this. They are probably wrong. They are wrong for the same reason why Mr. Harvey is wrong. They do not understand Ludwig von Mises.

MISES ON THE CRACK-UP BOOM: Mises was a senior advisor to the equivalent of the Austrian Chamber of Commerce after World War I. He understood monetary theory. His book on money, The Theory of Money and Credit, had been published in 1912, two years before the war broke out. In the post-War edition of his book, he wrote of the process of the hyperinflationary breakdown of a currency. He made it clear that such a currency is short-lived. People shift to rival currencies.

․

In 1949, his book “Human Action” appeared. In it, he discussed hyperinflation. He called this phase of the business cycle the crack-up boom. “The characteristic mark of the phenomenon is that the increase in the quantity of money causes a fall in the demand for money. The tendency toward a fall in purchasing power as generated by the increased supply of money is intensified by the general propensity to restrict cash holdings which it brings about. Eventually a point is reached where the prices at which people would be prepared to part with “real” goods discount to such an extent the expected progress in the fall of purchasing power that nobody has a sufficient amount of cash at hand to pay them. The monetary system breaks down; all transactions in the money concerned cease; a panic makes its purchasing power vanish altogether. People return either to barter or to the use of another kind of money (p. 424).”

Later in the book, Mises discussed the policy of devaluation: the expansion of the domestic money supply in a fruitless attempt to reduce the international value of the currency unit: “If the government does not care how far foreign exchange rates may rise, it can for some time continue to cling to credit expansion. But one day the crack-up boom will annihilate its monetary system. On the other hand, if the authority wants to avoid the necessity of devaluing again and again at an accelerated pace, it must arrange its domestic credit policy in such a way as not to outrun in credit expansion the other countries against which it wants to keep its domestic currency at par (p. 791).”

Mt. Harvey has described just such a policy. He concluded that the United States government can never go bankrupt. It can print its way out of every obligation. No, it can’t.

HYPERINFLATIONARY COLLAPSE: The expansion of the monetary base can go on until such time as commercial banks monetize all of the reserves on their books. Prices then rise to such levels that transactions no longer take place in the official currency unit. The division of labor contracts. The output of capital and labor falls. At some point, people adopt other currency units. They no longer cooperate with each other by means of the hyperinflated currency. Professor Steve Hanke has co-authored an article on the worst 56 hypernflations. He discovered that most of these in industrial nations were over in a couple of years. The crack-up boom ended them.

No nation can long pursue a policy of hyperinflation. It destroys the currency and destroys the division of labor. The result is starvation. The policy of hyperinflation ends before this phase. Members of society shift to other forms of money. This is why the policy of hyperinflation is useless in dealing with the 75-year obligations of the federal government to support old people through Social Security, Medicare, Medicaid, and federal pensions. These obligations are inter-generational. Hyperinflation lasts for months, not decades. When the government ends its policy of hyperinflation, it finds that it is still saddled with these obligations.

If the Federal Reserve resorts to hyperinflation, its retirement portfolio will reach zero value unless it shifts to foreign currencies, gold, or other hyperinflation hedges. It will publicly announce that the U.S. dollar is a failed currency, as manipulated by the FED.

If it refuses, then it will oversee Great Depression 2, monetary deflation, and the contraction of the division of labor. The U.S. government will go bankrupt. If Congress nationalizes the FED, then it will pursue hyperinflation. The crack-up boom will end the experiment.

At that point, all of the obligations to retirees will still remain. But the government will not have the money to pay them. The $222 trillion of present valued unfunded liabilities will still remain unfunded. The government’s obligations are inter-generational. Hyperinflation is not. The latter in no fundamental way reduces the former. This means that the government will default. This is 100% guaranteed.”

․

http://beforeitsnews.com/

“the catastrophe may happen well before Americans hit the polls in November.”

http://moneymorning.com/ob/faber-warns-everything-will-collapse/

Troop and materiel movements all over the country it seems…martial law? Something’s going on, and as usual we just don’t know what. I don’t know, but you alone, after informing yourself to the best of your ability, must decide what the truth is, and make your own decisions and act accordingly. For a multitude of reasons the month of October may well be an interesting time… – CP

2012-09-30 07:56:33

Source: