| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

The Economy: “Why Are We Bailing Out The Banks?”

by Karl Denninger

“Golem has an interesting post up this morning… “We’ve all seen the film ‘Groundhog Day’. Well, we’re in it. Every morning the radio plays a song which has the chorus, “I rob you babe”. And sure enough when the news comes on, they have. A full five years of pumping money in to the banks and still our leaders will not even consider that they might be wrong. They still insist, as they have from the start, that “There is no alternative’. Call it bail outs, call it QE, call it monetary policy, rescue or suicide, it doesn’t matter. What matters is we’re still doing it. So the simple reason our rulers insist on bailing out the banks is that by doing so the wealthy and the powerful are simply bailing out themselves and guaranteeing the continuation of a system which suits them perfectly.”

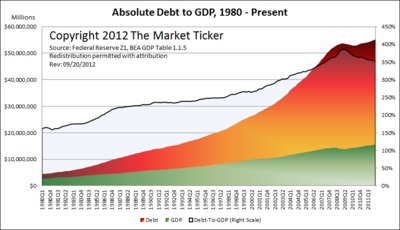

Actually, what matters from a macro economic viewpoint- and thus from a matter of policy- is whether what is being done has worked and more importantly whether it can work. There the answer is simple- no, and no. But then one is compelled to ask- why not? Take a look at this chart again:

Leaving aside whether the rich or the common person got the benefit is the simple question of what must happen in order to restart the cycle of averred “economic progress” that we had for those 30 years. That’s simple- the geometric growth of debt must resume.

But who is going to take that debt on? For debt to increase someone must accept responsibility for the new debt.

To restart the geometric cycle of debt increases we would have to find someone who can (and will) add $54 trillion in debt on their balance sheet in the United States over the space of less than ten years. So who’s it going to be?

Before you say “the government will do it via deficit spending” note that this would be more than a five-fold expansion of the public federal debt from today’s levels; more debt added per two year period than the entire last four on a continual 10 year basis. Do you really think the market will tolerate that? Can it be households? How? Mortgages would have to increase in size five-fold over the next ten years, which means house prices would have to increase close to four-fold. Plausible? No.

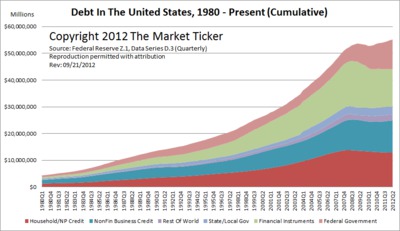

Business credit? We’ve wrung all the efficiency gains out we can get. This is why profit numbers are expected to decline this quarter. The “benefit” of screaming at people to work harder and take less compensation has run to its endpoint! That is what has supported equity markets. Every dollar of debt a corporation takes will depress equity prices as the debt:equity ratio will rise ratably. Never mind that corporations would have to increase their debt five-fold to make up enough for this to work. If they did, the S&P would trade at 200 and the DOW at 2,000. Financial instruments? That’s what blew up the world- and it’s still contracting. That is the very hole that government deficit spending is trying to fill in to prevent the banks from blowing up.

None of the other slices are large enough to garner more than a chuckle in potential consideration.That’s being done won’t work because it can’t work folks.

This isn’t so much about the right or wrong of bailing out the fat cats who have all their alleged “wealth” in paper that has its best and highest use on the commode. That’s a good debate to have, and all the righteous anger over bailing those people out is well-placed. But the policy question is more-simple- being entirely agnostic on who gets helped and why, is the alleged prescription able to lead to the claimed benefit? And there the answer is simple: No.

This, incidentally, is why you had better all be prepared. The more credit pumping that is done by the government the worse the impact on government services will be when failure occurs. And since success is mathematically impossible all we’re really arguing about here is timing.”

2012-10-09 14:05:42

Source: