| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Feud at The Fed: “Horrific Consequences” for Unlimited Easing

The Fed’s plan to purchase $40 billion in mortgage-backed securities and $45 billion in long-term US Treasuries every month for the foreseeable future is now creating internal feuds.

The Federal Reserve’s latest round of quantitative easing has no timetable to end or measurable goal. Yesterday, the Dallas Fed President said this policy without limits would result in “horrific consequences”.

Reuters is reporting today on these “deep divisions” at the Federal Reserve:

Charles Evans, president of the Chicago Federal Reserve Bank and one of the Fed’s most outspoken doves, said interest rates should stay near zero until the jobless rate falls to at least 6.5 percent. Such a policy would carry “only minimal inflation risks,” and could boost growth faster than otherwise, he said.

Evans, who rotates into a voting seat on the Fed’s policy-setting panel in January, also said the Fed should step up its program of quantitative easing in the new year to keep its overall level of asset purchases at $85 billion a month for most, if not all, of 2013.

But Dallas Fed President Richard Fisher, a self-identified inflation hawk, said the U.S. central bank could get into trouble if it does not set a limit on the amount of assets it is willing to buy.

“You cannot expand without limits without horrific consequences,” he told reporters on the sidelines of the conference organized by the Levy Economics Institute in Berlin. “There is no infinity in monetary policy, we know that from the German experience.”

No one at the privately-owned US central bank has been able to explain how spending $85 billion per month ($1.02 trillion for 2013) on these purchases will reduce unemployment and maintain dollar price stability, the only tasks the Fed is charged with.

In fact, they don’t even pretend to be achieving these duties anymore. Both Evans and Fisher agreed that fixing unemployment is more important than controlling high inflation. Therefore, they’re willing to trade one for the other.

“I am not worried about inflation right now, I am worried about an underemployed workforce in America,” said Fisher indicating that he is willing to go along to get along despite his “horrific consequences” remark.

Evans believes the Fed should keep interest rates at zero, continue or even “ramp up” purchasing Treasuries and mortgage-backed securities until the unemployment rate is 6.5 – 7 percent and inflation doesn’t threaten 3 percent.

And, of course, they are using the “official” numbers for inflation and unemployment which everyone now knows are bogus to begin with.

The only reason the official unemployment number is marginally improving is because hundreds of thousands are scrubbed from the equation.

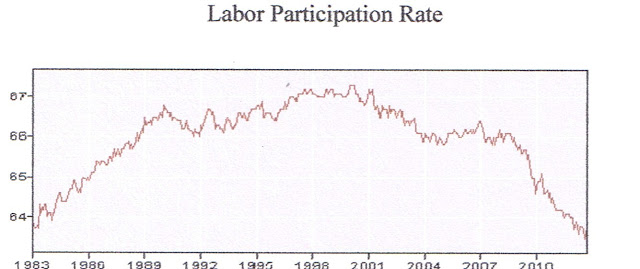

In September, Bloomberg reported, “The unemployment rate fell to 8.1 percent from 8.3 percent, but that was only because 368,000 people left the labor force. The share of working-age people who are either working or looking for work—known as the labor-force participation rate—fell to its lowest level since September 1981.”

|

| Source |

So it is highly unlikely that buying bad paper from banks and monetizing the US government’s debt will make one bit of difference for the real unemployment problem no matter how much they spend doing it. And when it doesn’t work, we can be assured of one thing, they will throw even more money at it and it will most certainly result in “horrific consequences” for the value of the dollar.

Delivered by The Daily Sheeple

Contributed by Activist Post of Activist Post.

2012-11-28 05:20:28

Source: http://www.thedailysheeple.com/feud-at-the-fed-horrific-consequences-for-unlimited-easing_112012

Source: