| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

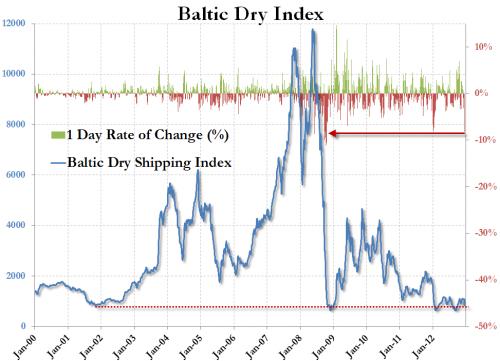

Baltic Dry Plunges By Over 8% Overnight, Most Since 2008

Wednesday, December 12, 2012 12:44

% of readers think this story is Fact. Add your two cents.

Baltic Dry

Plunges By Over 8% Overnight, Most Since 2008

Plunges By Over 8% Overnight, Most Since 2008

The BDI is

termed a leading economic indicator because it predicts future economic

activity

termed a leading economic indicator because it predicts future economic

activity

Submitted

by Tyler Durden on

12/12/2012 08:34

by Tyler Durden on

12/12/2012 08:34

It has been a

while since we looked at the Baltic Dry Index*, which when normalizing for the

excess glut in dry container ship supply (such as right now – 5 years after all

the excess supply in the industry – has long been normalized), continues to be

one of the best concurrent indicators of global shipping and trade.

while since we looked at the Baltic Dry Index*, which when normalizing for the

excess glut in dry container ship supply (such as right now – 5 years after all

the excess supply in the industry – has long been normalized), continues to be

one of the best concurrent indicators of global shipping and trade.

We look at it

today, moments ago it just posted an epic 8.2% plunge, crashing from 900 to

826, or the biggest drop since 2008! Of course, considering the collapse in

global trade confirmed in past days by both Chinese and US data, this should

not come as a surprise, although we are certain it will merely bring out the

BDIY apologists who tell us that supply and demand here (like in every other

Fed-supported market) are completely uncorrelated.

today, moments ago it just posted an epic 8.2% plunge, crashing from 900 to

826, or the biggest drop since 2008! Of course, considering the collapse in

global trade confirmed in past days by both Chinese and US data, this should

not come as a surprise, although we are certain it will merely bring out the

BDIY apologists who tell us that supply and demand here (like in every other

Fed-supported market) are completely uncorrelated.

*The Baltic Dry Index (BDI) is a number issued daily

by the London-based Baltic

Exchange. Not restricted to Baltic Sea

countries, the index provides “an assessment of the price of moving the

major raw materials by sea. Taking in 23 shipping routes measured on a

time-charter basis, the index covers Handysize, Supramax, Panamax, and Capesize dry bulk

carriers carrying a range of commodities including coal, iron ore and grain.”[1]

by the London-based Baltic

Exchange. Not restricted to Baltic Sea

countries, the index provides “an assessment of the price of moving the

major raw materials by sea. Taking in 23 shipping routes measured on a

time-charter basis, the index covers Handysize, Supramax, Panamax, and Capesize dry bulk

carriers carrying a range of commodities including coal, iron ore and grain.”[1]

Why economists

and stock market investors read it

and stock market investors read it

Most directly,

the index measures the demand for shipping capacity versus the supply of dry bulk

carriers. The demand for shipping varies with the amount of cargo that is

being traded or moved in various markets (supply

and demand).

the index measures the demand for shipping capacity versus the supply of dry bulk

carriers. The demand for shipping varies with the amount of cargo that is

being traded or moved in various markets (supply

and demand).

The supply of

cargo ships is generally both tight and inelastic—it takes two years to build a new

ship, and ships are too expensive to take out of circulation the way airlines

park unneeded jets in deserts. So, marginal increases in demand can push the

index higher quickly, and marginal demand decreases can cause the index to fall

rapidly. e.g. “if you have 100 ships competing for 99 cargoes, rates go

down, whereas if you’ve 99 ships competing for 100 cargoes, rates go up. In

other words, small fleet changes and logistical matters can crash

rates…”[5]

The index indirectly measures global supply and demand for the commodities

shipped aboard dry bulk carriers, such as building materials, coal, metallic ores, and grains.

cargo ships is generally both tight and inelastic—it takes two years to build a new

ship, and ships are too expensive to take out of circulation the way airlines

park unneeded jets in deserts. So, marginal increases in demand can push the

index higher quickly, and marginal demand decreases can cause the index to fall

rapidly. e.g. “if you have 100 ships competing for 99 cargoes, rates go

down, whereas if you’ve 99 ships competing for 100 cargoes, rates go up. In

other words, small fleet changes and logistical matters can crash

rates…”[5]

The index indirectly measures global supply and demand for the commodities

shipped aboard dry bulk carriers, such as building materials, coal, metallic ores, and grains.

Because dry bulk

primarily consists of materials that function as raw

material inputs to the production of intermediate or finished

goods, such as concrete, electricity, steel, and food, the index is also seen as an efficient economic indicator of future economic growth and

production. The BDI is termed a leading economic indicator because it

predicts future economic activity.[6]

primarily consists of materials that function as raw

material inputs to the production of intermediate or finished

goods, such as concrete, electricity, steel, and food, the index is also seen as an efficient economic indicator of future economic growth and

production. The BDI is termed a leading economic indicator because it

predicts future economic activity.[6]

Another index,

the HARPEX,

focuses on containers freight. It provides an insight on the transport of a

much wider base of commercial goods than commodities alone.

the HARPEX,

focuses on containers freight. It provides an insight on the transport of a

much wider base of commercial goods than commodities alone.

Other leading

economic indicators—which serve as the foundation of important political and

economic decisions—are often measured to serve narrow interests, and subjected

to adjustments or revisions. Payroll or employment numbers are often estimates;

consumer confidence appears to measure nothing more than sentiment, often with

no link to actual consumer behavior; gross national product figures are

consistently revised, and so forth. Unlike stock and bond markets, the BDI

“is totally devoid of speculative content,” says Howard Simons, an

economist and columnist at TheStreet.com. “People don’t book freighters

unless they have cargo to move.”[7]

economic indicators—which serve as the foundation of important political and

economic decisions—are often measured to serve narrow interests, and subjected

to adjustments or revisions. Payroll or employment numbers are often estimates;

consumer confidence appears to measure nothing more than sentiment, often with

no link to actual consumer behavior; gross national product figures are

consistently revised, and so forth. Unlike stock and bond markets, the BDI

“is totally devoid of speculative content,” says Howard Simons, an

economist and columnist at TheStreet.com. “People don’t book freighters

unless they have cargo to move.”[7]

NESARA- Restore America – Galactic News

2012-12-12 12:21:39

Source: http://nesaranews.blogspot.com/2012/12/baltic-dry-plunges-by-over-8-overnight.html

Source: