| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

The Economy: “Bottom Line: Why We Must Stop Deficits NOW”

by Karl Denninger

“Here’s the bottom line folks:

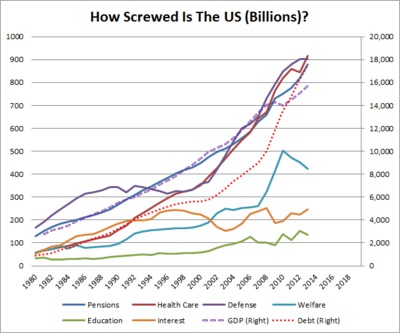

Those are the three categories on the top- Pensions (Social Security, mostly), Health Care and Defense. One of them is discontinuous- Defense. It is possible that the rough tripling from roughly 1998 to today has stopped. If so then its impact on what is to come is not material.

Before you protest, please read the rest of this. That leaves two categories- “Pensions” and “Health Care”. Note the right scale graph, the purple dashed line. This is the reason that the so-called pundits, from Bernanke on down, all argue that we must deal with this sometime in the reasonable future, but right now we’re not about to hit the wall. That is, GDP is rising in rough conformance with those three major contributors to the government’s spending profile. And it is GDP (in one form or another) upon which all taxes are levied. Therefore, by first appearance, they argue, we are not about to have an imminent crack-up.

They’re wrong.

Note the category called “interest” and that it has been rising much slower that has the debt over the last few years. It tracked the debt growth until approximately 1996. This is when active manipulation took hold by both The Fed and Government. It is when, approximately, we transferred from growth in the economy to debt-financing for consumption.

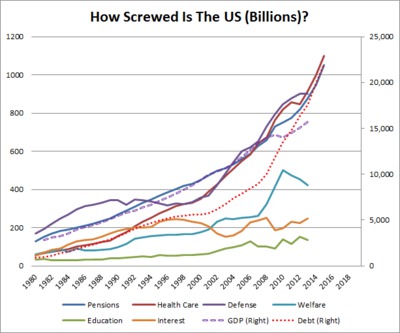

Now I want to project out a few other assumptions just a couple of years. First, I will project forward both Pensions and Health Care to 2015, along with the Debt.

Note that our public debt has exceeded $20 trillion. Note also that we have added $355 billion in annual expense to the budget and exactly none of it is discretionary. The so-called “sequester”, at $80 billion a year, is (by the second year) less than one quarter of this amount, and that assumes that every penny of it sticks.

Now I want to make one final assumption- The Fed loses control of interest rates because it is forced to abandon its programs due to either runaway “inflation” or the ongoing destruction of purchasing power in the American people’s lives. That ongoing destruction is happening now and it is responsible for the zero GDP print last quarter. This is an emergent problem, not one for the future two, three or five years down the road, because without growing GDP that purple line does not go upward and the alleged ability to cope with the growing expenditures instantly evaporates.

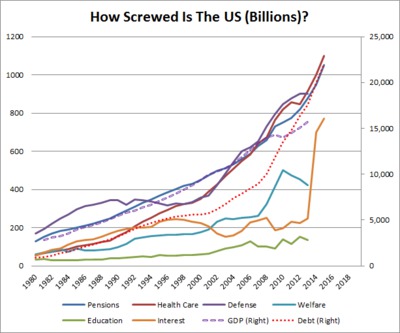

That’s the bad news. The worse news is what happens if The Fed is forced to back off. Let’s assume that the One Year T-Bill rate goes back to the midpoint of its historical range (not including the 1980s discontinuity), or about 3.5%. What happens?

Pensions we can fix; OASDI can be repaired. We did the first piece of it with the expiration of the payroll tax cut that was (foolishly) passed. The rest is handled by indexing (now!) the retirement age to longevity. The medical spending problem cannot be fixed within the government alone. It has to be addressed in the medical system as a whole. In short, the medical system must contract in terms of dollars spent by about 80% and then rise at no faster than GDP in the future.

This has to happen now. It can happen now, but doing so is a political nightmare. We cannot do this in the future. We cannot do this over a period of 10, 20 or 30 years. We must do it right now, this year, today, in the present tense. There is no other option and I don’t give a damn how much the medical providers, hospitals and lobbyists scream.

“Scotty, I need warp power in 2 minutes or we’re all dead.”

Really.

Yes, I’m fully-aware that the government and Fed will try to “kick the can” in some way, even if they see this as the imminent outcome of their acts. But any further “can-kicking” just makes the problem worse by compounding the debt and expense profile even more.

Some of the back-of-the envelope numbers I had been working with gave us until about 2020 or thereabouts before the discontinuous spike occurred. Those models were ones that I tweaked back in 2007 and were the reason for my alarm at the time- we had less than a decade left before the impact started. But now we have both Europe (which is falling back into recession), Britain (which is an utter basket case) and Japan, which has effectively declared that it will debase its currency and destroy the purchasing power of its citizens into a depleted savings base. In addition we have what is now a known set of outcomes from Obamacare, which I predicted would be an utter disaster and for many people would double their health care expenses (mostly insurance) and which is now known to be correct.

These changes have forced updates to those graphs and expectations and unfortunately they have pulled forward the “aw crap” date to as few as two years from now. Note that these are quite-conservative estimates. If defense spending rises from here then it’s even worse. If welfare spending rises (E.g. more food stamps anyone?) then it’s even worse. If we subsidize more student loans, it’s even worse. This estimate and work assumes that no other part of the federal budget increases by one single net penny- a ridiculously conservative set of assumptions.

If the corrective actions aren’t taken in the immediate present tense then what you’re looking at is the outcome that will happen, and when that outcome occurs immediate collapse of the government’s funding model is assured. This is not speculative- it is arithmetic.

The only option The Fed would have would into such an event would be to try to “QE” the difference via what at that point amount to completely-phony auctions and “open market operations” on top of what it’s doing now- that is, roughly double the destruction of purchasing power that is taking place today via their “QE-to-infinity.” But that simply transfers the deficit to the population directly via that destruction of purchasing power and it falls almost-entirely on the bottom two quintiles of the income spectrum.

That’s a recipe for a nearly-guaranteed civil war as you will generate over 100 million Americans with nothing to lose.”

2013-02-24 15:30:13

Source: