| Online: | |

| Visits: | |

| Stories: |

Cabela’s YA GOTTA READ THIS!! -ITS A MUST!

Tuesday, February 25, 2014 14:34

% of readers think this story is Fact. Add your two cents.

|

Now, it’s getting personal. Taxing FISHING Gear with the extremely high “medical device tax”…. I just looked it up…. NO JOKE…. Fishing gear and a whole bunch of other non-medical stuff, such as tires, coal and etc…. What have they done to us??? click on the IRS URL below….

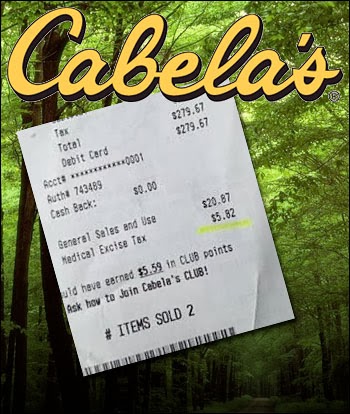

Medical Excise Tax on Retail Receipts This is an image of a sales receipt from Cabela’s, a popular sporting goods store

The 2.3% Medical Excise Tax that began on January 1st is supposed to be “hidden” from the consumer, but it’s been brought to the public’s attention by hunting and fishing store Cabela’s who have refused to hide it and are showing it as a separate line item tax on their receipts, the email states.

I did some research and found directly from the IRS ‘s website information that PROVES this to be true and an accurate portrayal of something hidden in Obamacare that I was not aware of! Now being skeptical of this I went to the IRS website and found this! Q1. What is the medical device excise tax? A1. Section 4191 of the Internal Revenue Code imposes an excise tax on the sale of certain medical devices by the manufacturer or importer of the device. Q2. When does the tax go into effect? A2. The tax applies to sales of taxable medical devices after Dec. 31, 2012 . Q3. How much is the tax? A3. The tax is 2.3 percent of the sale price of the taxable medical device. See Chapter 5 of IRS Publication 510, Excise Taxes, and Notice 2012-77 for additional information on the determination of sale price. IRS.gov Chapter Fivehttp://www.irs.gov/publications/p510/ch05.html So being more curious I clicked on “Chapter 5 of IRS Publication 510.” And what do I find under “MEDICAL DEVICES” under “MANUFACTURERS TAXES”? The following discussion of manufacturers taxes applies to the tax on: Sport fishing equipment; Fishing rods and fishing poles; Electric outboard motors; Fishing tackle boxes; Bows, quivers, broadheads, and points; Arrow shafts; Coal; Taxable tires; Gas guzzler automobiles; and Vaccines. IRS.gov I think we have definitely been fooled, if we believe that the Affordable Care Act is all about health care. It truly does appear to be nothing more than a bill laden with a whole lot of taxes that we the people have yet to be aware of.

Please pass this on. I am still incredulous that this can go on. Where is our press ? I guess it’s just like Nancy Pelosi said. “We have to pass it to see what is in it .” What is next? What else is there we do not know about? |

Source: http://nesaranews.blogspot.com/2014/02/cabelas-ya-gotta-read-this-its-must.html

Unbelievable! I have nothing to say, I’m speechless.