| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

“Is the Great Correction Over?”

Thursday, February 20, 2014 12:58

% of readers think this story is Fact. Add your two cents.

“Is the Great Correction Over?”

by Bill Bonner

“First, the market news: The Dow lost 89 points yesterday. Gold fell by four bucks an ounce. And now the good news: The Great Correction is over! Hallelujah! People are going deeper into debt… and getting divorced again.

No kidding. Bloomberg reports: “The number of Americans getting divorced rose for the third year in a row to about 2.4 million in 2012, after plunging in the 18-month recession ended June 2009, according to US Census Bureau data. “As the economy normalizes, so too do family dynamics,” said Mark Zandi, chief economist at Moody’s Analytics Inc. in West Chester, Pennsylvania. “Birth rates and divorce rates are rising. We may even see them rise strongly in the next couple of years, as households who put off these life-changing events decide to act.”

Divorces were at a 40-year low in 2009, according to Jessamyn Schaller, an economics professor at the University of Arizona in Tucson, citing data from the federal government’s National Center for Health Statistics. The divorce rate more than doubled between 1940 and 1981 before falling a third by 2009, according to figures from NCHS, based in Hyattsville, Maryland.

Back to Normal? Well, that’s great news, isn’t it? Things are going back to normal. If the Great Correction is over, you can expect higher consumer prices… more jobs… lower bond prices… higher bond yields… and a higher rate of economic growth. A real recovery, finally.

But if the Great Correction isn’t over, you can expect more of what we have seen for the last five years – low consumer-price inflation (officially only 1.5% over the last 12 months), low bond yields (and high prices)… more QE… and sluggish growth.

Pity the poor schlep who has been forced to stay with his wife because he couldn’t afford to get rid of her. Here’s his chance: The Fed has gamely tried to boost credit, borrowing, spending, consumer prices and divorce rates. But although it can help push borrowing costs down through QE, it can’t make people borrow.

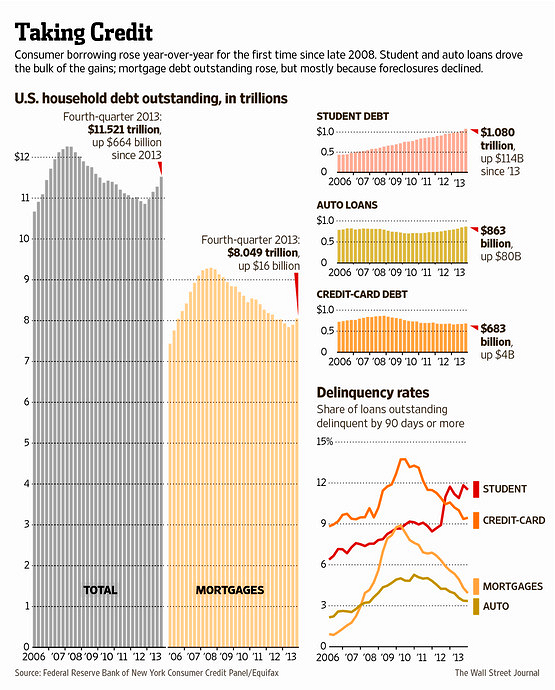

Result: stagnation. But now… for the first time since 2008… households are borrowing more than they are paying off or defaulting on. Aggregate consumer debt in the US rose 2.1% in Q4 to $11.52 trillion – the largest quarterly rise since Q3 2007. From the Wall Street Journal: “Household Debt Jumps as Banks Loosen Up“ ”People actually want to step up and take on more debt,” said one analyst quoted by the Journal.

Click image for larger size.

QE Has Been a Dud: For the last five years, households paid down debt. This is why QE has been such a dud when it comes to boosting real economic output. The Fed can fiddle with bond yields. But it can’t make consumers borrow. Nor can it boost the money supply. Banks have to lend for the money supply to rise. If they don’t, it doesn’t matter how much the Fed puffs up the monetary base. But if households’ appetite for borrowing suddenly improves… and if the Fed continues to hold interest rates to the floor… there could soon be a substantial increase in the money supply.

This would give consumer prices the boost the Fed has been aiming for. It may even get more than it was hoping for. Higher consumer price inflation could spook overseas dollar holders… causing them to give their tattered Franklins and shopworn Grants the heave-ho, back to where they came from. But looking more closely, neither divorce numbers nor the debt numbers are sure signs of economic health.

After five years of subnormal divorce numbers, you would expect them to regress to the mean, no matter what was going on in the economy. As for the recent increase in US household debt, the biggest gain came in student loans, which rose 12%. In fact, it rose almost exactly as much as borrowers aren’t paying. Delinquencies are at about 12%, too.

The Federal Debt Devil: Why do people want to go to school, rather than work? Because they can’t find good jobs. Why do they borrow, rather than pay for it out of savings? Because they have no savings. Why do they borrow from the federal government? Because this lender performs no credit check.

Once the federal debt devil has you in his grip, it is very hard to get away. You may be prepared for a job, but that doesn’t mean a job is prepared for you. And the only way you can put off making payments on your debt is to borrow more and stay in school. Deeper into the bowels of debt hell you go. That’s why student loan defaults are growing so fast. Nearly one in eight borrowers hasn’t made a payment in the last 90 days – the highest delinquency rate of any form of debt. And it’s going up. Delinquency rates rose by 40% in the last three years. How much of that debt will never be repaid?

And remember: When debts go unpaid, it impacts banks’ capital. This, in turn, puts downward pressure on lending… and the money supply. The fastest growing category of debt owes its growth to the failure of the economy, not its success. Is the correction really over? Maybe not.”

- http://www.thedailyreckoning.com

Source: http://coyoteprime-runningcauseicantfly.blogspot.com/2014/02/is-great-correction-over.html