| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Weather Derivatives ??

I’ve speculated privately this was going on with HAARP weather manipulations after watching the TV series Rubicon which has a plot of cabal of Military Industrial Think Tank types who trigger terrorist attacks to speculate in high frequency trading of market swings. Death can come by many means including weather… I think its also the reason for the high secrecy surrounding HAARP and “Geo-Engineering”… -AK

Found here: http://www.rumormillnews.com/cgi-bin/forum.cgi?read=2249

excerpted from here: http://jimstonefreelance.com/weatherderivatives.html

Weather Derivatives ??

Posted By: Susoni

Date: Monday, 20-Oct-2014 18:05:20

(snip)

Clandestine insider trading involving the weather is happening on the stock market and has been since 1996. This trading involves betting on what the weather will be. In the age of weather modifications, can anyone see a conflict of interest with this? Does California have a huge put option out on it? Is that why HAARP technology is obviously being used to destroy California agriculture?

This was a new one for me, but it makes perfect sense: If powerful people can control the weather now, why not use the weather as a trading option and rake it in big with a rigged game?

IiA posted the following to the forum, and it is a shocker.

Topic: Weather Derivatives

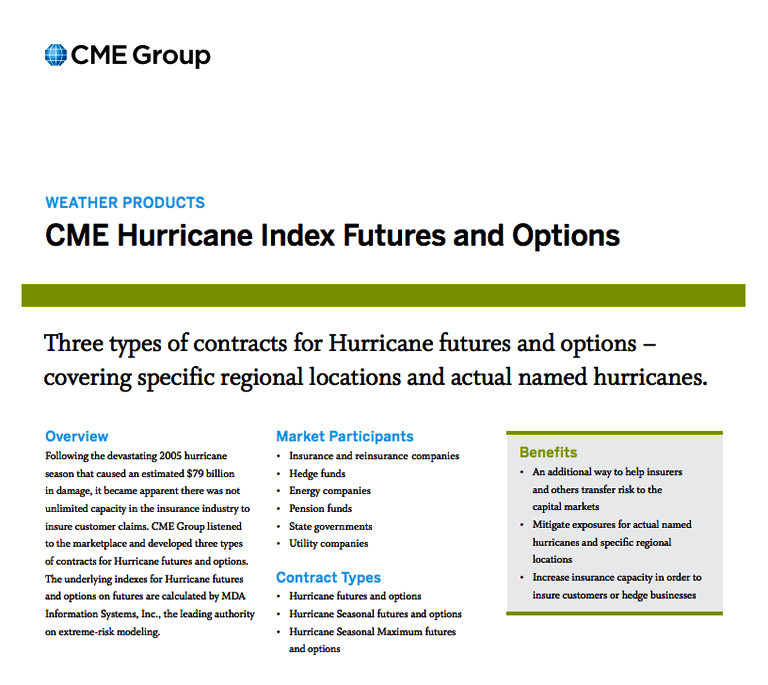

The first weather derivative deal was in July 1996 when Aquila Energy structured a dual-commodity hedge for Consolidated Edison Co. Weather derivatives slowly began trading over-the-counter in 1997. The Chicago Mercantile Exchange introduced the first exchange-traded weather futures contracts and corresponding options, in 1999. A major early pioneer in weather derivatives was Enron Corporation.

Following this YT uploaded Oct 17, 2014, the Chicago Mercantile Exchange (CME) has deleted all information on hurricane weather contracts from their website. Trading weather derivatives, while having access to technology to modify temperature, rainfall, drought and tweak the paths of hurricanes, constitutes insider trading. Also snapshots on the wayback archive now reroute, I have the screenshots.

Is there relevant disclosure about the tweaking of Hurricane Gonzalo and Typhoon Vongfong, or why now? https://www.youtube.com/watch?list=UUp7x…YZGSV4H7T8

The CME currently lists weather derivative contracts for 25 cities in the United States, eleven in Europe, six in Canada, three in Australia and three in Japan. Most of these financial instruments track cooling degree days or heating degree days, but other products track snowfall and rainfall in at ten separate U.S. locations. The CME Hurricane Index, an innovation developed by the reinsurance industry provides contracts that are based on a formula derived from the wind speed and radius of named storms at the point of U.S. landfall.

Source: http://americankabuki.blogspot.com/2014/10/weather-derivatives.html