| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

More Than $2 Trillion In Corporate Bonds ‘Disappear’

Alhambrapartners.com

I have not yet commented on the huge revisions in corporate debt to this point (the revisions were released on September 18 with the regular update to the Z1 Financial Accounts of the United States, formerly Flow of Funds) because there was so very little information surrounding the changes. I had hoped by now somebody somewhere with a better perspective would have commented and clarified, even if only partially, why $2.4 trillion in corporate debt disappeared.

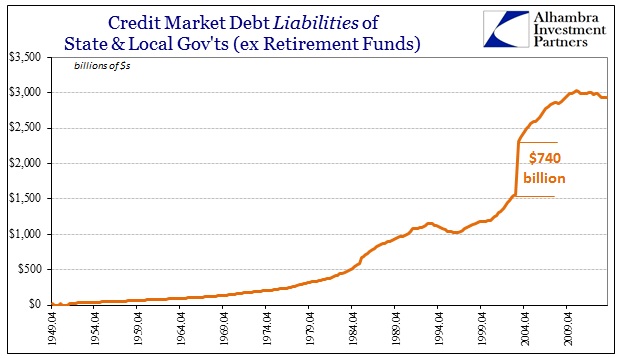

Before describing the nature of the latest revisions, it should be emphasized that this kind of rethinking is not unique and does happen from time to time. In 2011, for example, the Flow of Funds calculations changed the manner in which they tracked municipal debt, suddenly “finding” $740 billion that was previously uncounted. In that instance, however, they offered a reasonable justification:

The instrument tables on municipal securities and loans (tables F.211 and L.211) have been revised from 2004:Q1 forward to reflect a change in data sources. Data on debt outstanding and net issuance for state and local governments, nonprofit organizations, and nonfinancial corporate business (industrial revenue bonds) are now based on data from Mergent, a private data vendor. The new data indicate that municipal securities and loans outstanding in 2004:Q1 is $740 billion greater than previously estimated in the flow of funds accounts. The estimate of household holdings of municipal securities and loans is revised up by about $840 billion, on average, from 2004 forward.

With the way the Z1 is calculated, the Household Sector takes on a sort of plug variable to absorb any changes that cannot otherwise be classified elsewhere (including the myriad “other” and “miscellaneous” line items). That makes some sense given that households don’t report their “balance sheet” in any fashion, so it is where the most mystery, and thus most flexibility, resides. The net result was a discontinuity starting in 2004 where Households were believed to own three quarters of a trillion more in muni bonds, as the other side indicated that municipal and state governments owed roughly the same amount in increase.

That being said, the change in nonfinancial business debt (almost all of it at the corporate level) is of a different variety – which raises some separate issues. First of all, the differing calculations purportedly arise out of a mechanical change (which immediately draws to mind how the CPI has been whittled down), rather than solely the logical course of shifting data providers. All the Federal Reserve, the providers and statisticians taking care of Z1, has to say on the topic is:

This should be no surprise… the corporate debt disappearance marries up perfectly with all the “borrowed money (increased taxpayer debt)” the Obama administration (and democrat senate approved) gave to wall street to erase their “BIG DONORS” debts. The elitists have been looting the nation.

Jungle Bro.

Again the sheeple lay down and are fleeced.As long as they can go bowling,have their six pack and watch nfl football

they are fullfilled.

Nobody cares,the people have become apathetic ,funfilled and the hollywood mentality the new norm.So therefore judgement is coming down.Will they wake up from their stuppor?