| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Silver to S&P Ratio: What It Tells Us : The Market Oracle

By: DeviantInvestor

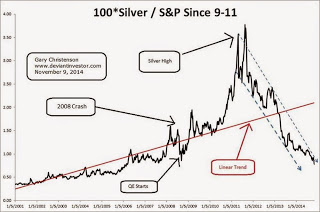

Take the price of silver, multiply by 100, divide by the S&P 500 Index and chart it for 30 plus years. What do we see?

Now look at the 13 years since 9-11 when the gold, silver and commodities bull markets began.

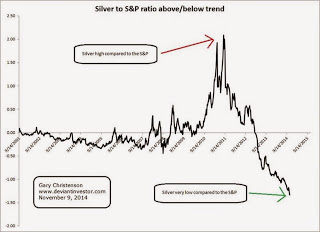

Now examine the difference between the ratio and the linear trend shown above in red.

COMPARISONS:

Item S&P Silver

3 – 5 year history Triple since lows Down by 70%

Recent activity All-time highs 70% below all-time highs

The Fed & QE QE levitates the S&P QE – not much help

Chinese purchases Probably not Huge purchases

Warfare increasing Likely to hurt S&P Likely to help silver

Middle-East trauma Likely to hurt S&P Likely to help silver

Political turmoil Likely to hurt S&P Likely to help silver

We could go on, but it is clear to me that the S&P is near all-time highs and is at risk from declining QE, excessive valuation, increasing wartime threats, Middle-East trauma, and US political turmoil. Silver is near a 5 year low, 70% off its highs, and likely to rise based on the same issues that could hurt the S&P.

The Si/SP ratio shows that silver is deeply oversold and far below its typical levels. The ratio is at an 8 year low, even below the 2008 silver crash lows, and not far above 30 plus year lows.

Based on Friday’s upticks, last week may have been the turning point for silver prices and the silver to S&P ratio. Or perhaps the S&P will continue reaching for the sky even though QE is supposedly diminishing, while silver prices drop further below the cost of production. Both seem unlikely but we shall see.

What is clear is that silver and gold are currently selling at bargain prices and the S&P is selling at very high prices. If the silver market has finally found a bottom then silver is – right now – an excellent investment, financial insurance, and protection for your purchasing power and savings.

For those who bought silver (and gold) at higher prices, the long-term trend is up and will eventually express itself. Waiting for the turnaround is painful, but now is a lousy time to lose sight of the “big picture” and sell at a loss. Instead, now is a far better time to buy.

If you bought silver at lower prices, you probably feel good knowing that your investment is currently profitable even at these post-crash levels. Further, silver prices are highly likely to increase substantially in the next few years.

KISS! Keep Increasing Silver Stack! Keep It Simple – Silver!

via marketoracle

Source: