| Online: | |

| Visits: | |

| Stories: |

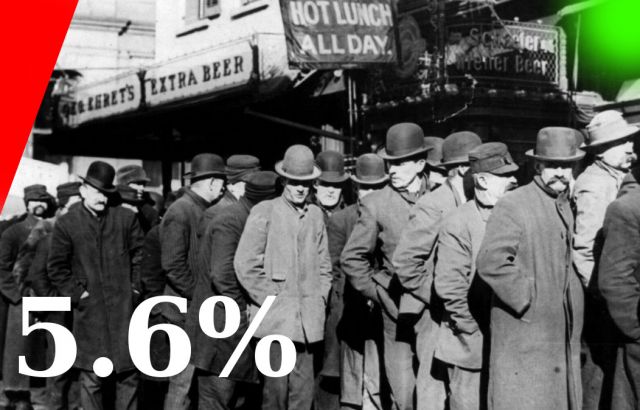

Dollar Collapse Due to 5.6% Unemployment? [ video ]

The collapse of the dollar is being masked by the misleading statistics. Why is the unemployment statistic so misleading that even shadowstats dont have it right and how does the US government get away with it?

South Carolina’s unemployment rate dropped to 5.3 percent in April, lower than in December 2007, when it stood at 5.5 percent on the eve of the Great Recession.

The share of South Carolina adults with jobs, however, has barely rebounded.

The same contrast is visible in most states. Unemployment rates, the most familiar and famous of labor market indicators, are nearing pre-recession lows. But the shares of adults with jobs — or employment rates — look much less healthy.

The reason is that the numbers are not quite two sides of a coin. The employment rate counts everyone with a job, while the unemployment rate counts only people actively seeking work. It excludes most people who are unemployed.

There is little question that the markets will eventually suffer a rather nasty mean reversion. However, bull markets don’t end simply due to old age, it requires a catalyst. The problem remains that throughout history the “catalyst” that finally triggers a market reversion and coinciding economic recession are rarely identified in advance. Could that catalyst here be public confidence lost due to unemployment?