| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Everyone Is Fleeing Oil’s Biggest Fund

Musings On The Finite Statist Machine

“Smart money” is leaving crude oil… zero point energy on the horizon? -AK

http://www.bloomberg.com/news/articles/2015-05-28/oil-fund-s-biggest-outflow-in-six-years-signals-rally-may-falter

by Moming Zhou

1:01 AM CEST

May 29, 2015

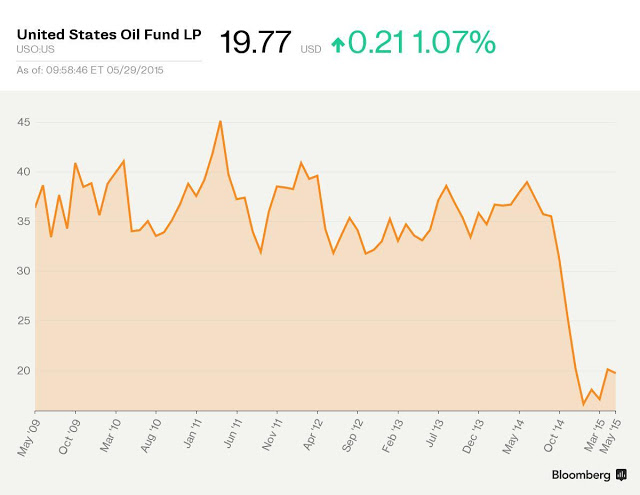

The biggest U.S. exchange-traded fund that tracks oil is heading for the largest two-month outflow in six years, raising concern that crude’s 30 percent rally may stall.

Holders of the United States Oil Fund, known as USO, have withdrawn almost $1 billion so far in April and May, according to data compiled by Bloomberg. Crude dropped about $12 a barrel after a $1.4 billion exodus from the fund in the two months ended June 2009.

Oil has rebounded from a six-year low in mid-March on speculation that the falling number of drilling rigs will reduce output. U.S. crude stockpiles near the highest level in 85 years and OPEC’s refusal to cut production will continue to weigh on prices, according to Goldman Sachs Group Inc., Deutsche Bank AG and Citigroup Inc.

“The oil rebound has run out of gas and now you are seeing nervous investors with itchy trigger fingers bailing out of USO,” Eric Balchunas, a Bloomberg Intelligence analyst, said May 27. “They don’t want to get burned by another drop in oil.”

West Texas Intermediate crude for July delivery added 69 cents to $58.37 a barrel in electronic trading on the New York Mercantile Exchange at 11:41 a.m. London time, up from a closing price of $43.46 on March 17. Futures rallied 25 percent in April, the biggest monthly gain since May 2009, and have fallen 2.1 percent so far in May.

Source: http://americankabuki.blogspot.com/2015/05/everyone-is-fleeing-oils-biggest-fund.html