| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

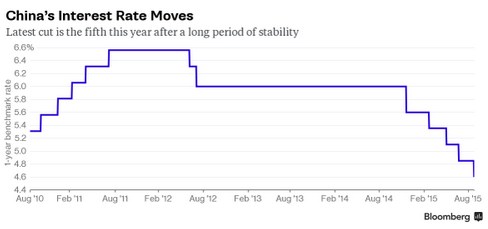

China's interest rate move is its fifth cut this year

The People’s Bank of China has lowered its interest rate for the fifth time since November boosting European stocks higher in afternoon trading. The one-year lending rate has been reduced by 25 basis points to 4.6 percent, which is record low for China.

China’s surprise yuan devaluation on Aug. 11 led to a tightening in liquidity as the PBOC subsequently bought its currency to stabilize the exchange rate and curb capital outflows. The yuan may face more downside pressure as a result of the latest monetary easing, making it harder to keep depreciation in check. A 22 percent stock market plunge over four days added pressure for broad stimulus as authorities pull back from other direct efforts to boost equities.

“The government has stopped using unconventional intervention in the stock market and decided to use more traditional and more market-based methods to boost market momentum and help the real economy,” said Lu Ting, chief economist at Huatai Securities Co. “Beijing has released some positive signals and these will help global stock markets. Using monetary easing to drive stocks and the economy is a method more acceptable to international capital markets.” …. http://www.bloomberg.com

Source: http://luismmx.blogspot.com/2015/08/chinas-interest-rate-move-is-its-fifth.html