| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

What Happens if Yuan Gains Reserve Currency Status?

Americans have benefitted GREATLY from the Dollar’s status as the “world’s reserve currency.” Currently, no nation may purchase oil without paying for it in dollars.

International Monetary Fund representatives have given China strong signals that the yuan is likely to soon join the fund’s basket of reserve currencies, known as Special Drawing Rights, Chinese officials with knowledge of the matter told Bloomberg News this week. Here’s a primer on what that means.

What is a Special Drawing Right?

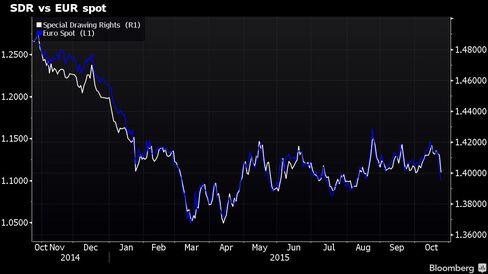

The fund created the SDR in 1969 to boost global liquidity as the Bretton Woods system of fixed exchange rates unraveled. While the SDR is not technically a currency, it gives IMF member countries who hold it the right to obtain any of the currencies in the basket — currently the dollar, euro, yen and pound — to meet balance-of-payments needs. So the ability to convert SDRs into yuan on demand is crucial. Its value is currently based on weighted rates for the four currencies.

How much of these SDRs are out there?

The equivalent of about $280 billion in SDRs were created and allocated to IMF members as of September, compared with about $11.3 trillion in global reserve assets. The U.S. reported about $50 billion in SDR holdings as of August.

Why does China want this status so badly?

In a 2009 speech, People’s Bank of China Governor Zhou Xiaochuan said the global financial crisis underscored the risks of a global monetary system that relies on national reserve currencies. While not mentioning the yuan by name, Zhou argued that the SDR should take on the role of a “super-sovereign reserve currency,” with its basket expanded to include currencies of all major economies.

Chinese officials have since been more explicit. After meeting President Barack Obama last month at the White House, President Xi Jinping thanked the U.S. for its conditional support for the yuan joining the SDR. Winning the IMF’s endorsement would allow reformers within the Chinese government to argue that the country’s shift toward a more market-based economy is bearing fruit.

Why is the IMF likely to approve this?

Global use of the yuan has surged since the IMF rejected SDR inclusion in the last review in 2010. By one measure, the currency became the fourth most-used in global payments with a 2.79 percent share in August, surpassing the yen, according to the Society for Worldwide Interbank Financial Telecommunication, known as Swift.

The IMF uses several indicators to determine if a currency is “freely usable,” the benchmark for inclusion in the SDR basket. IMF staff members said in a report in August that the yuan trails its global counterparts in major benchmarks, such as its use in official reserves, debt holdings and currency trading. But staffers have also stressed that the fund’s 24 executive directors, who will make the final call, will need to use their judgment.

Many major economies, including the U.S., Germany and U.K., say they’re prepared to back the yuan’s inclusion if it meets the IMF criteria. Supporting the yuan may boost relations between China and countries such as the U.K., which has sought to make London a major yuan trading hub.

Adding the yuan to the basket may also help the IMF improve its standing with the Chinese. China and other emerging markets were supposed to gain greater representation at the fund under reforms agreed to in 2010, but the U.S. Congress has yet to ratify the changes.

What’s likely to happen to yuan assets in the longer term?

At least $1 trillion of global reserves will migrate to Chinese assets if the yuan joins the IMF’s reserve basket, according to Standard Chartered Plc and AXA Investment Managers.

Foreign companies’ issuance of yuan-denominated securities in China, known as panda bonds, could exceed $50 billion in the next five years, according to the World Bank’s International Finance Corp.

“Once the Chinese yuan becomes part of the SDR, central-bank reserve managers and institutional investors will automatically want to accumulate yuan-denominated assets,” Hua Jingdong, vice president and treasurer at IFC, said in an interview in Lima earlier this month during the IMF and World Bank annual meetings. “It will be strategically important for China to welcome all kinds of issuers to become regular issuers in China’s onshore market.”

Thanks for taking your time to check out this information. Love to hear what YOU think in the comments section below! If you find that you liked this story, don’t forget to hit the “RECOMMEND CONTRIBUTOR” and “RECOMMEND STORY” button at the top of the page so that I can bring you more articles like this.

If you got something out of this, consider sharing it with others.

And before ya go…let’s stay connected:

Subscribe to my YouTube channel

Follow me on FaceBook

Follow me on Twitter

Subscribe to my Website:

Source: http://www.bloomberg.com/news/articles/2015-10-24/what-will-it-mean-for-the-yuan-to-get-imf-reserve-currency-nod-