| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Stung by Oil, Distressed-Debt Traders See Worst Losses Since ’08

Musings On The Finite Statist Machine

Simone Foxman

Jodi Xu Klein

November 24, 2015 — 2:52 AM CET Updated on November 24, 2015 — 12:58 PM CET

Knighthead, Candlewood, Mudrick hedge funds under pressure `It wasn’t just energy,' one manager says as funds fall 5%

It’s mid-November, but for investors who trade in the debt of distressed companies, the year’s already done — and they lost.

Hedge funds that specialize in the debt are grappling with their worst declines in seven years. Funds managed by Knighthead Capital Management, Candlewood Investment Group, Mudrick Capital Management and Archview Investment Group all posted losses through October. And year-end bonuses at Wall Street desks that trade distressed debt could be slashed by a quarter, Options Group said.

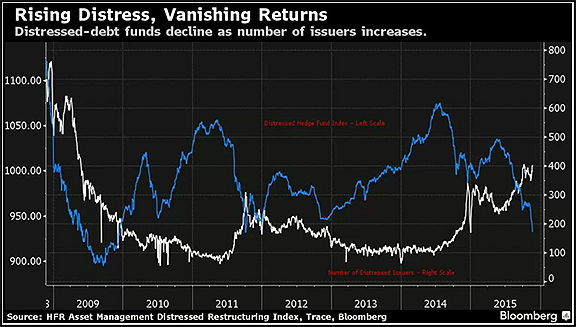

After six years of easy-money central-bank policies kept over-leveraged companies afloat and left scant opportunities for traders who profit off the market’s scrap heaps, a rout in commodities prices in 2014 presented what had seemed like a perfect chance to buy again. Instead, those prices only declined further this year, causing the debt of everyone from oil drillers to coal miners to fall deeper into distress. As the losses intensified, gun-shy investors pulled back from almost anything that smacked of risk, spreading the losses to industries from retail to technology.

“Most distressed situations have not worked out in 2015,” said David Tawil, president of distressed hedge fund Maglan Capital, which lost 5.4 percent in the first 10 months of 2015. “It wasn’t just energy. It was anything with loads of leveraged debt on it.”

Distressed hedge funds dropped 5 percent in 2015 through October, putting them on pace for their worst year since 2008, when they lost 25 percent. They’re lagging behind hedge funds across indexes, which are flat for the year, according to Chicago-based data provider Hedge Fund Research Inc.

Rough November

November isn’t looking like it will be much better. A Bank of America Merrill Lynch index of distressed debt is down almost 8 percent this month as the average price of bonds in the benchmark dropped to 57 cents on the dollar, from as high as 75.6 cents in February.

Mudrick Capital lost 16 percent this year through Oct. 31 in its main fund, according to a person with knowledge of its returns. A $1 billion special-situations fund managed by Candlewood is down 11 percent, according to a document obtained by Bloomberg. And Knighthead Capital, which manages $3.4 billion, lost 8.7 percent in its main fund, according to performance updates.

Source: http://americankabuki.blogspot.com/2015/11/stung-by-oil-distressed-debt-traders.html