| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Benjamin Fulford’s Background to the Fact that the ’08 Subprime has Nothing on This Year’s Galloping Oil Crash

READ SOURCE STORY HERE Big_Banks_Running_Scared‘

Benjamin Fulford’s background Material is extremely relevant here unfolding-global-banking-rese

Since the start of 2015, 42 North American oil companies have filed for bankruptcy 130,000 good paying energy jobs have been lost in the United States, and at this point 50 percent of all energy junk bonds are “distressed” according to Standard & Poor’s. As you will see below, some of the big banks have a tremendous amount of loan exposure to the energyindustry, and now they are bracing for big losses. And the longer the price of oil stays this low, the worse the carnage is going to get.

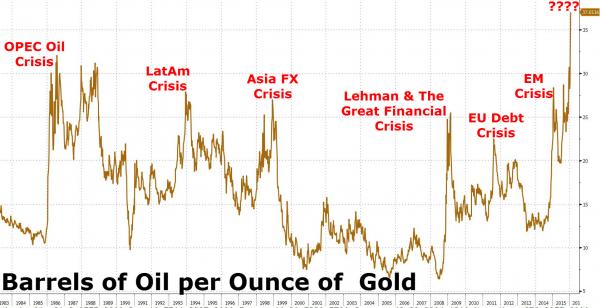

Today, the price of oil has been hovering around 29 dollars a barrel, and over the past 18 months the price of oil has fallenby more than 70 percent. This is something that has many U.S. consumers very excited. The average price of a gallon of gasoline nationally is just $1.89 at the moment, and on Monday it was selling for as low as 46 cents a gallon at one station in Michigan.

But this oil crash is nothing to cheer about as far as the big banks are concerned. During the boom years, those banks gave out billions upon billions of dollars in loans to fund exceedingly expensive drilling projects all over the world.

Now those firms are dropping like flies, and the big banks could potentially be facing absolutely catastrophic losses. The following examples come from CNN…

For instance, Wells Fargo (WFC) is sitting on more than $17 billion in loans to the oil and gas sector. The bank is setting aside $1.2 billion in reserves to cover losses because of the “continued deterioration within the energy sector.”

JPMorgan Chase (JPM) is setting aside an extra $124 million to cover potential losses in its oil and gas loans. It warned that figure could rise to $750 million if oil prices unexpectedly stay at their current $30 level for the next 18 months.

Citigroup is another bank that also has a tremendous amount of exposure…