| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

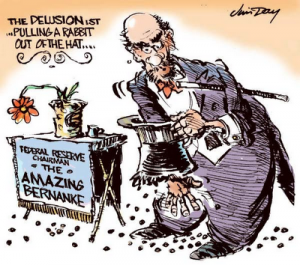

Bernanke Says Don’t Worry, “It’s Only Temporary”

MISH’S

Global Economic

Trend Analysis

Earlier today, in Bernanke Begs Congress to Address “Fiscal Cliff”, Pledges to Hold Interest Rates Near Zero Through Mid-2015 Even If Economy Picks Up I commented on the Bernanke’s self-serving responses to his own questions.

In this post I want to focus on another disingenuous part of his speech that I did not comment on previously. Specifically …

With monetary policy being so accommodative now, though, it is not unreasonable to ask whether we are sowing the seeds of future inflation. A related question I sometimes hear–which bears also on the relationship between monetary and fiscal policy, is this: By buying securities, are you “monetizing the debt”–printing money for the government to use–and will that inevitably lead to higher inflation? No, that’s not what is happening, and that will not happen. Monetizing the debt means using money creation as a permanent source of financing for government spending. In contrast, we are acquiring Treasury securities on the open market and only on a temporary basis, with the goal of supporting the economic recovery through lower interest rates. At the appropriate time, the Federal Reserve will gradually sell these securities or let them mature, as needed, to return its balance sheet to a more normal size. Moreover, the way the Fed finances its securities purchases is by creating reserves in the banking system. Increased bank reserves held at the Fed don’t necessarily translate into more money or cash in circulation, and, indeed, broad measures of the supply of money have not grown especially quickly, on balance, over the past few years.

Read more at http://globaleconomicanalysis.blogspot.com/#6TrlDFDMH1frOBwf.99

Fair Use Notice: This post contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are makingsuch material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any suchcopyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest inreceiving the included information for research and educational purposes. For more information go to: www.law.cornell.edu/uscode/17/107.shtml.If you wish to use copyrighted material from this site for purposes of your own that gobeyond ‘fair use’, you must obtain permission from the copyright owner.