| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

If You Keep Your Money With The Banksters, They Are LOL.

A Monday Morning Musing from Mickey the Mercenary Geologist

April 15, 2013

O Gold! I still prefer thee unto paper,

Which makes bank credit like a bark of vapour. Lord Byron, 1815.

It was 1:30 am on Thursday March 28 on the West Coast of North America. Still jet-lagged a week following my return from Asia, I awoke after a mere three hours sleep to an epiphany.

The thought evidently coincided with the time that banksters in Cyprus braced for a run on reserves. Their intervening measures to prevent bank failures included severely discounting the value of large investors’ deposits and radically limiting cash withdrawals for peones to 300 euros a day.

Here’s the idea that woke me up: If you keep your money with the Banksters, they are LOL.

I must question why any smart person with financial assets in any fiat currency held anywhere in the world would freely choose to keep the majority of that cash in any bank anywhere in the world.

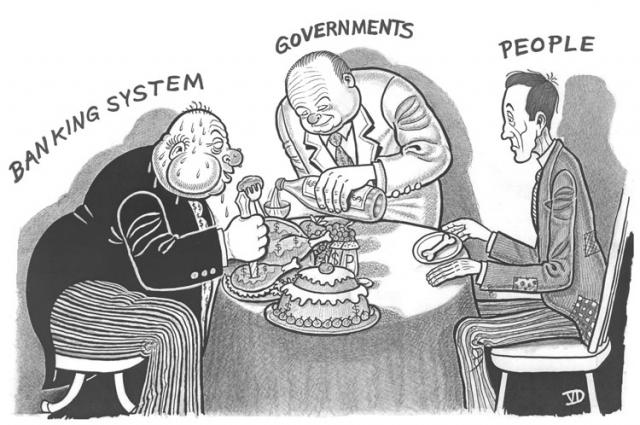

At its very best, a bank is a 10:1 fractional reserve system; i.e., the bank backs 10% of its outstanding loans by the equivalent in paper money. In actuality, the majority of banks are leveraged much more than that. Fractional banking has existed for centuries. In the early 1600s, central governments in Europe began to manipulate money supply and credit in order to regulate banks, restrict bank runs, and prevent bank failures.

In early 1700s, England formed a joint public-private banking monopoly designed to alleviate its national debt. The South Seas Company was a conspiratorial scam involving government accountants, stock promoters, and politicians based on a purported but non-existent trade monopoly in South America. In 1720, the “Bubble Act” was designed to preserve the monopoly by outlawing competition, but it soon resulted in massive bank failures, financial panic, and economic collapse. Henceforth, the term “bubble” refers to any market that goes parabolic over a short period of time.

I know an ex-banker in Albuquerque whose hometown bank failed during the US housing market collapse in 2008. He was ruined but at least his small clients’ investments were backed and honored by central government-issued bank insurance, made whole by the keyboard creation of fiat dollars. His creditors were less fortunate, writing off huge sums of bad debt.

The current Cypriot bank crisis and the resulting closure of its stock market for two weeks illustrates that banking remains an inherently risky business, often fueled by speculative credit markets that are subject to collapse.

History has shown us repeatedly that all fiat money systems eventually fail and lead to government default and demise. Even the value of the United States dollar has been rolled back twice in the past 80 years.

In 1933, President Roosevelt devalued the dollar 70% by raising the fixed price of gold from $20.67 to $35.00. His executive order also reneged on the government’s promise to redeem paper currency in gold upon demand and made it illegal for citizens to own more than five ounces of bullion.

The Breton Woods Agreement of 1944 made the US dollar the world’s reserve currency and it alone was decreed as redeemable in gold and only by other central governments. In 1971, the US defaulted again when Nixon closed the gold-for-dollars option and floated its money on world exchanges. Since then, greenbacks have had no backing except the United States of America’s promise to pay.

Since the first baby boomers were born in 1946, American citizens have been taught, cajoled, and perhaps even brainwashed into thinking that the almighty dollar, the world’s reserve currency, is a stable fiat money beyond question and reproach. Acceptance of this idea requires a belief that the US government is solvent and will remain so into the future.

But this very same government has gone bankrupt and defaulted on its financial obligations twice during my parents’ lifetimes. Why would you think they will not do it again in yours? Is it your faith, belief, or a combination of both?

I kindly remind you what Mark Twain had to say about that: Faith is believin’ what you know ain’t so.

Face the truth folks, your money is not real money unless it is held in physical gold.

Let’s look at current facts about the American banking system and how it takes care of your money:

continue article at GoldSeek.com: