| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

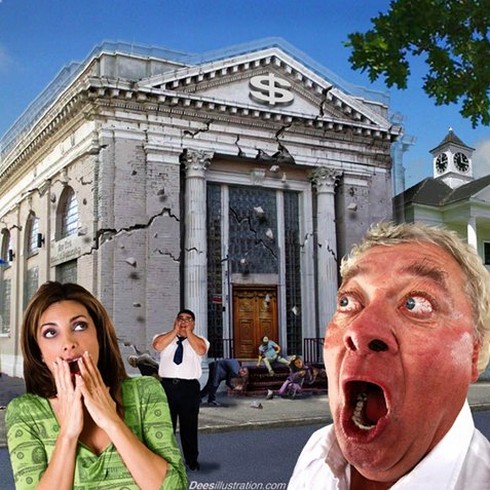

Central Bank Have Set The Stage For A Disaster That Will Make 2008 Look Like A Joke

Via: Zero Hedge

The Central Bank policies of the last five years have damaged the capital markets to the point that the single most important item is no longer developments in the real world, but how Central banks will respond to said developments.

Let us take a moment to digest that. Before 2008, for the most part, when something happened in the world, an investor would think about how that issue would affect the markets.

Today, that same investor will try to analyze how the Central Banks will react to that issue, not the impact of the issue itself. This is why, for various periods between 2008 and today, the markets would rally on terrible economic data and other economic negatives: traders believed that because the data was bad the Fed would be more inclined to engage in more easing.

After all, why do we invest? We invest because we want to make money. And when it comes to investing, we prefer easy money: gains that have a high probability of success. And thanks to Central Banks cutting interest rates over 500 times and printing over $10 trillion in money since 2008, what’s the easiest way to make money by investing today?

Front-run Central Banks policies.

Consider Europe. In 2012, ECB President Mario Draghi promised to do “whatever it takes” to keep the Euro in one piece. Since that time, nothing has really improved in Europe’s economy.

France is approaching a triple dip recession. Germany may re-enter recession before the year’s end. Spain remains an economic basket-case. Portugal just suffered another major bank failure. And on and on.

And yet, bond yields on European Sovereign debt have fallen to multi-century lows. Germany’s 10 year is now at 1%… an ALL TIME low. The reason for this? Investors, convinced that the ECB will buy sovereign bonds or, at a minimum, drive bond yields lower, have poured into European bonds.

~ ”THEIR DAY OF RECKONING, IS RIGHT AROUND THE CORNER” ~

THUS SAYS THE LORD GOD ALMIGHTY…