| Online: | |

| Visits: | |

| Stories: |

Asian stock market sell off and half a trillion of repo transactions made by the FED!

Asian stock markets fell by as much as 5% yesterday dragging most other indices with them. Strangely enough these sudden corrections seems to be preceded by massive repo transactions from the FED.

There is an ongoing liquidity crises and it’s massive in scale. The FED used more than half a trillion in repo transactions during the last week of december! Is it any wonder to see the markets undergoing a correction?

Something is definetly happening in the derivatives sector and their doing all they can to hide it from the general public!

There is an interesting article about the FED involving liquidity problems and the derivatives sector.

From: IRD (Investment Research Dynamics)

Title : ”Is The Fed Beginning To Lose Control?”

Exerpt of the article:

I enjoyed Stockman’s piece on Dec. 30th – LINK – concerning the impact of the meltdown in the commodity industries. I think people are seriously underestimating the impact. – New Year’s Day email from John Embry

I would like to point out that John and I always discuss a few pleasant topics as well as plot the demise of the global economy. On that note: Happy New Year everyone (Buon Anno a tutti).

I pointed out to John that Stockman’s analysis did not include any consideration of the amplification caused by derivatives on the destruction to the world/U.S. economy that is going to be felt from the price collapse of oil and basic industrial commodities. In fact, I would argue, though it’s next to impossible to prove, that the Fed spends a significant amount of time working to prevent any evidence of the brewing derivatives nightmare from reaching overt public view, in conjunction with the ECB, BoE and U.S. Treasury (the exchange stabilization fund).

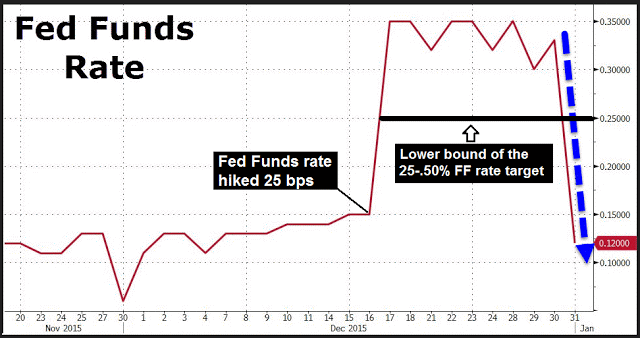

An interesting event first brought at least to my attention by Zerohedge occurred on December 31. The Fed funds (FF) rate plunged significantly below the lower bound of the Fed’s .25-.50% FF rate to the rate set that day at .12% (source: Zerohedge, with my edits in black)

The question is, why did this happen? To begin with, although it went largely unnoticed, the Fed also jacked up the interest it pays on bank excess reserves (IOER) from .25% to .50% at the same time it nudged up the FF rate. Let’s first review what Fed funds are and how they work mechanically.

The Fed funds is the mechanism by which banks who have cash in excess of what they need to meet reserve requirements lend these “excess” reserves to banks who might need a temporary loan in order meet reserve requirements. It is thus a system by which banks with extra liquidity make short term loans to banks who need liquidity. The Fed funds rate is the rate at which excess funds are loaned out. The FF rate is set in a competitive bidding process each day based on the supply of funds made available to lend and the demand to borrow these funds.

In theory the Fed is supposed to be able to “control” the FF rate by regulating the amount of ready-liquidity in the banking system. The Fed “adjusts” systemic liquidity using the reverse repo and repo “tools” (it can also adjust the minimum reserve ratio but this is rare). If the FF rate is headed above its target range, the Fed repos cash liquidity into the banking system. Conversely, it uses the reverse repo if the FF rate is headed below the lower bound of its target range in order to remove systemic liquidity.

Full article at:

http://news-uncensored-fresh.blogspot.be/2016/01/asian-stock-market-sell-off-and-half.html