| Online: | |

| Visits: | |

| Stories: |

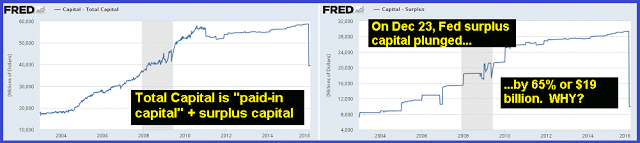

Did Something Blow A Hole In The Fed’s Balance Sheet?

Full article:

http://news-uncensored-fresh.blogspot.be/2016/02/did-something-blow-hole-in-feds-balance.html

[Note: A reader alerted me to this – LINK – which explains the $19 billion drop in Capital Surplus. Congress passed a law requiring all surplus capital at the Fed in excess of $10 billion to be transferred to the Treasury as part of the Highway Bill passed in early December. But does not change the thesis for the banking system underlying the analysis below: the banking system is starting to collapse again from billions in defaulting loans – loans that banks refuse to write down in value, just like they refused to mark down the value of the collapsing mortgage derivatives trusts in 2008 per “The Big Short.” It also calls into question the credibility of a Federal Reserve that is allowed and enabled to operate with just .8% book capital – $39 billion in book capital against $4.442 trillion in liabilities covered by just $4.482 trillion in “assets.”

Related subject video: