| Online: | |

| Visits: | |

| Stories: |

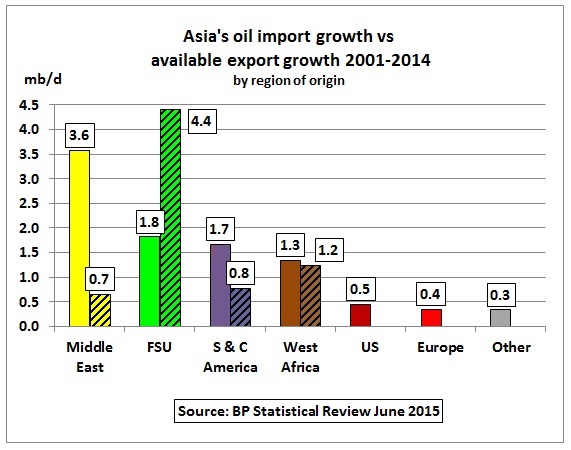

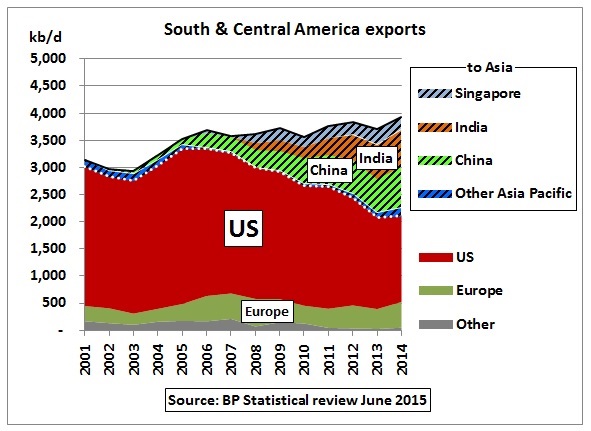

Exports are in decline along with increased Asian imports this spells disaster!

The Wall Street, lobbyist corporatocracy is staging a WAR on the middle class of America by failing to meet middle class demands. Banks are serving the elite with cheap low interest fiat funding for a casino on Wall Street! Meanwhile in America stagflation has run rampant. Coffee and food increase in price in smaller parcels. Oil per barrel is not truly reflected for a gallon of gas in America! Quite frankly, America is living off less quality goods imported into this Country via policies by the Federal Reserve and the Federal Government. Furthermore, small business is not getting loans to expand or start up in some cases.

The three branches of government have caved to slave 3rd world labor at the expense of the middle class in America and when your too big to fail; this false government just taxes the poor and middle class. This will lead to Poor vs. Rich in America. And Donald Trump is for the Rich!

I propose a 15% tariff on all imported goods and the tax should be used to support small business loans in America to create innovation and strengthen America’s economy again. Also a great surge in quality goods and more jobs will be created from this proposal.

http://crudeoilpeak.info/asia-depends-on-middle-east-for-66-pct-of-its-oil-imports

U.S. Census Bureau U.S. Bureau of Economic Analysis NEWS U.S. Department of Commerce * Washington, DC 20230 U.S. INTERNATIONAL TRADE IN GOODS AND SERVICES March 2016 The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $40.4 billion in March, down $6.5 billion from $47.0 billion in February, revised. March exports were $176.6 billion, $1.5 billion less than February exports. March imports were $217.1 billion, $8.1 billion less than February imports.

http://www.bea.gov/newsreleases/international/trade/tradnewsrelease.htm

In early 1922 10,000 Mark would buy over 250 Pounds of Meat.

By the end of the year it would buy only 5 pounds of Meat.

In June bread is 3.50 Mark a loaf.

U.S. Census Bureau

U.S. Bureau of Economic Analysis

NEWS

U.S. Department of Commerce * Washington, DC 20230

U.S. INTERNATIONAL TRADE IN GOODS AND SERVICES

March 2016

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of

Commerce, announced today that the goods and services deficit was $40.4 billion in March, down

$6.5 billion from $47.0 billion in February, revised. March exports were $176.6 billion, $1.5

billion less than February exports. March imports were $217.1 billion, $8.1 billion less than

February imports.

Import Tariffs

An import tariff is a tax collected on imported goods. Generally speaking, a tariff is any tax or fee collected by a government. Sometimes tariff is used in a non-trade context, as in railroad tariffs. However, the term is much more commonly applied to a tax on imported goods.

There are two basic ways in which tariffs may be levied: specific tariffs and ad valorem tariffs.

A specific tariff is levied as a fixed charge per unit of imports. For example, the US government levies a 51 cent specific tariff on every wristwatch imported into the US. Thus, if 1000 watches are imported, the US government collects $510 in tariff revenue. In this case, $510 is collected whether the watch is a $40 Swatch or a $5000 Rolex.

An ad valorem tariff is levied as a fixed percentage of the value of the commodity imported. “Ad valorem” is Latin for “on value” or “in proportion to the value.” The US currently levies a 2.5% ad valorem tariff on imported automobiles. Thus if $100,000 worth of autos are imported, the US government collects $2,500 in tariff revenue. In this case, $2500 is collected whether two $50,000 BMWs are imported or ten $10,000 Hyundais.

Occasionally both a specific and an ad valorem tariff are levied on the same product simultaneously. This is known as a two-part tariff. For example, wristwatches imported into the US face the 51 cent specific tariff as well as a 6.25% ad valorem tariff on the case and the strap and a 5.3% ad valorem tariff on the battery. Perhaps this should be called a three-part tariff!

As the above examples suggest, different tariffs are generally applied to different commodities. Governments rarely apply the same tariff to all goods and services imported into the country. One exception to this occurred in 1971 when President Nixon, in a last-ditch effort to save the Bretton Woods, system of fixed exchange rates, imposed a 10% ad valorem tariff on all imported goods from IMF member countries. But incidents such as this are uncommon.

Thus, instead of one tariff rate, countries have a tariff schedule which specifies the tariff collected on every particular good and service. The schedule of tariffs charged in all import commodity categories is called the Harmonized Tariff Schedule of the United States (HTS). The commodity classifications are based on the international Harmonized Commodity Coding and Classification System (or the Harmonized System) established by the World Customs Organization.