| Online: | |

| Visits: | |

| Stories: |

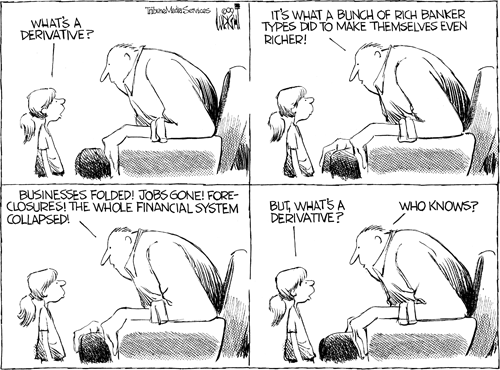

Greg Hunter with Ellen Brown: Cascade of Derivative Defaults Would Bring Everything Down

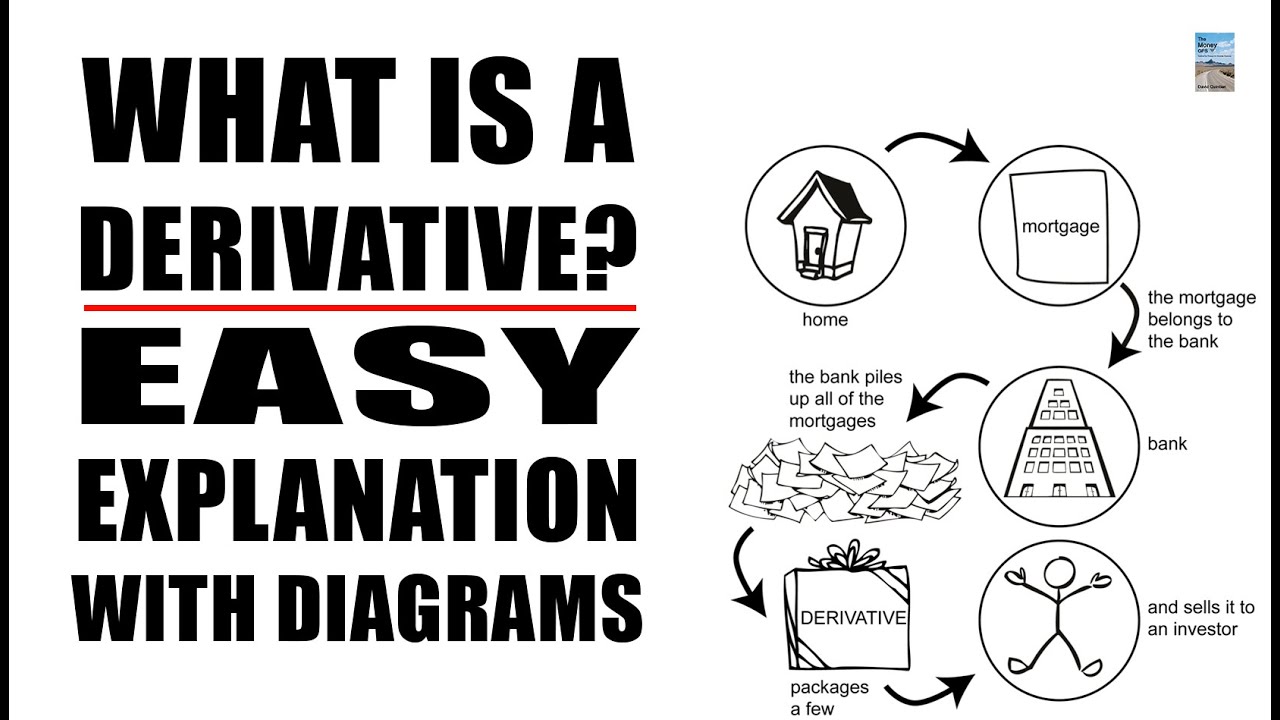

[Greg Hunter] Countries are up to their necks in debt that cannot not be paid. The derivatives propping the debt up are hundreds of trillions of dollars. Public banking expert Ellen Brown contends, “The concern is this $500 trillion of derivatives just on sovereign debt. There is $100 trillion in sovereign debt globally, which is a huge bill, and then you have all these derivatives betting against it with credit default swaps that would pay off in the event of a default. So, they can’t let any of these governments go bankrupt. They can’t write down the debt, and they can’t write off the debt as they should. These are impossible debts in Europe, particularly like in Greece. They are impossible debts to pay, but the central banks, for example in the EU, will not let any of these countries go bankrupt because the fear is it would trigger a cascade of defaults among the derivatives players, which would bring everything down.”

Join Greg Hunter of USAWatchdog.com as he goes One-on-One with Ellen Brown, creator of the Web-of-Debt Blog at EllenBrown.com.

All links can be found on USAWatchdog.com: http://usawatchdog.com/financial-crash

https://www.youtube.com/watch?v=ySvacUZcQL8#t=14.010489

[Zurich Times] Deriatives are an example of how with Complexity the Criminals nowadays hide their Crimes. When something is so Complicated and Difficult to even Understand, who will spend the Time to Break it Down?