| Online: | |

| Visits: | |

| Stories: |

Trump market euphoria impacts precious metals demand: plummets in West, Surges in East!

With the Trump euphoria pushing the broader markets to new all-time highs, it has impacted precious metals demand considerably… especially in February. Precious metals investors believing the White House “Grandiose plans”, of making American great again, have cut back seriously on their precious metals buying.

There seems to be a percentage of the alternative community that are convinced that Trump will actually put the U.S. back to the way it was in the 1960’s. And that is, back to a manufacturing powerhouse with high-paying jobs. While this would be a wonderful thing to do, the continued disintegration of the global oil industry, just won’t allow it to happen.

IT WAS A ONE-TIME DEAL, and that period has come and gone…. FOREVER

Regardless, Western demand for precious metals declined considerably in February versus the same month last year. A few years ago I spent more time publishing articles on gold and silver demand, but have refocused my analysis on how energy will impact the precious metals, mining and the overall economy.

However, Louis at Smaulgld.com does an excellent job publishing articles on precious metals demand. So, I have used some of his data and one of his charts.

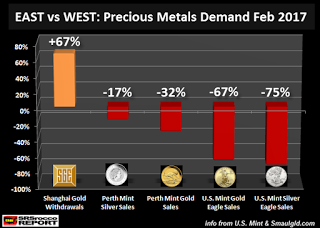

As I stated above, the Trump market euphoria has taken the wind out of precious metals investor recently. According to the data from Smaulgld.com and the U.S. Mint, sales of gold and silver have plummeted in the West (especially USA), but surged in the East:

As we can see, Shanghai Gold Exchange withdrawals surged 67% in February versus the same month last year, while Perth Mint silver sales declined 17%, Perth Mint Gold sales dropped 32%, U.S. Gold Eagles fell 67% and Silver Eagle sales plummeted 75%.

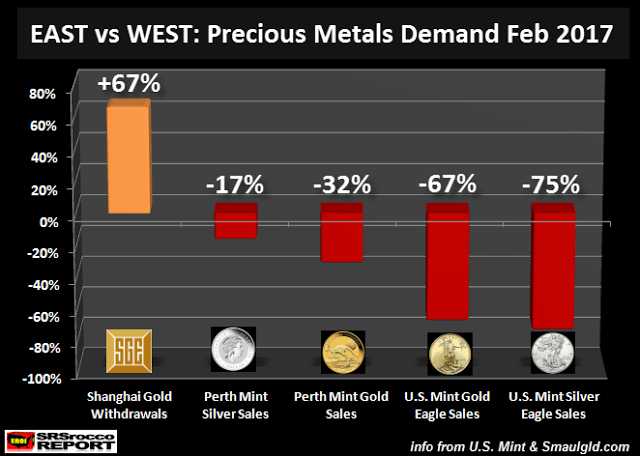

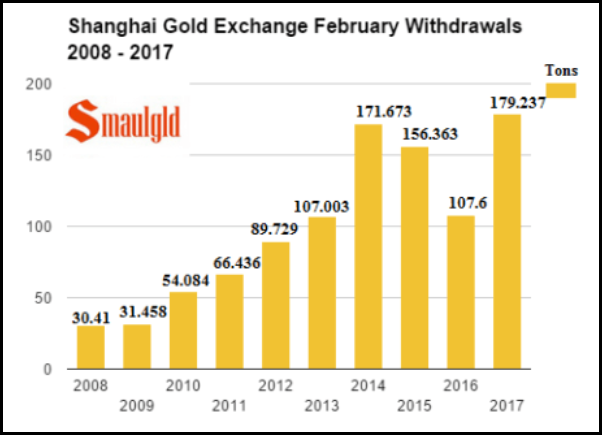

According to Louis’s article, Shanghai Gold Exchange February Withdrawals Highest On Record, he published the following chart:

Chinese Shanghai Gold Exchange withdrawals were 179 metric tons (mt) in February compared 107 the same month last year. Gold withdrawals from the Shanghai Gold Exchange are a pretty good proxy for the physical metal demand taking place in China. We must remember, global monthly gold mine supply is approximately 265 mt. Which means, the Shanghai Gold Exchange withdrawals of 179 mt accounted for two-thirds of global gold monthly mine supply. That’s a heck of a lot of demand… from just one country.

Full article at:

http://news-uncensored-fresh.blogspot.be/2017/03/trump-market-euphoria-impacts-precious.html