| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

–Mathematical proof that deficits should be increased. Send it to your favorite debt-hawk

Mitchell’s laws:

●The more budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity starves the economy to feed the government, and leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

==========================================================================================================================================

One of the most important and timely equations in economics is:

Federal Deficits = Net Private Savings + Net Imports

This neither is theory or even hypothesis. It is an accounting description of U.S. dollar flow. No economist disputes this equation.

The equation shows that federal deficits are the ultimate source of all dollars, and despite economically suicidal efforts to reduce deficits, if there were no deficits there would be no dollars. Without federal deficits, your net savings — even Bill Gates net savings — would be zero.

“Deficit” and “debt” fool most people, because these words sound negative. But think about it this way:

A federal “deficit” occurs when the federal government creates and spends more dollars than it receives in taxes. Similarly, when the government runs a surplus, the government takes more dollars out of the economy than it sends into the economy. A government surplus is the economy’s deficit.

The added dollars from federal deficit spending go to one of two places:

1. Into the U.S. economy, where they become Net Savings, or

2. To foreign economies to pay for Net Imports

Thus, the equation: Federal Deficits = Net Private Savings + Net Imports

Banks create dollars by lending, but those are not net dollars. For every dollar created by a bank, a loan obligation also is created –- the new dollars are offset by new obligations, so they net to zero. Only the federal government creates net savings dollars.

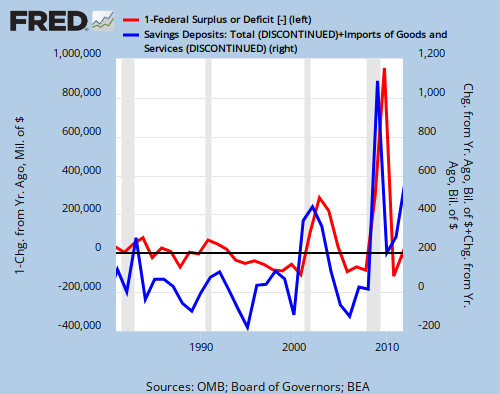

Lately, the blogosphere has been crackling with graphs illustrating this simple concept. First, I received an Email from several economists, containing an illustrative graph from Warren Mosler’s site. Then, I sent them back the following graph which shows Federal Deficits (red line) and Total Savings Deposits at all Depository Institutions plus Imports of Goods and Services (BOPMGSA)

(The lines would be exactly coincident but for slight measurement differences. Also, “Total Savings Deposits at all Depository Institutions” is not identical with Net Private Savings, and Imports of Goods and Services is not Net Imports.)

The graph makes this point clear: The more deficits rise, the more net savings rise.

The misnamed “deficit” is the source of all net dollars, i.e. all net private savings. Cutting deficits cuts private savings, which depresses the economy. Cutting deficits is a prescription for depression.

The Tea Party, Romney/Ryan, the Chicago Tribune, AARP and the Wall Street Journal editors all act on behalf of the upper 1% income group. They tell you the myth that federal deficit and debt are “unsustainable” and should be reduced. They never explain why a Monetarily Sovereign nation cannot “sustain” its deficits.

The 1% wants you to believe the myth, because that belief leads to your acceptance of cuts to social benefits and a large and growing income gap between the 1% and the 99%.

Reducing the deficit takes dollars out of the economy. When the government deficit spends, dollars flow into your pockets. When the government taxes, dollars flow out of your pockets. It’s that simple.

Because the government is Monetarily Sovereign it can create endless dollars. It does not need taxes. It does not need to borrow the dollars it creates. It can support endless Medicare, endless Medicaid and endless Social Security and never bounce a check.

Federal social programs will be in financial trouble only if the government cuts federal spending. It’s a self-fulfilling action. The more deficit cutting, the more financial trouble, which (according to the 1%) “requires” more deficit cutting, and on and on, until the lower 99% are sucked dry.

Don’t let the 1% starve you to feed a Monetarily Sovereign government that does not need to be fed. Vote against all tax increases and benefit cuts.

(By the way, if the Ryan budget doesn’t really cut Medicare, but actually “saves” Medicare, why does Ryan repeatedly assure those 55 and older, that the plan will not apply to them? Does he think we are so selfish we don’t care what happens to our kids?)

Rodger Malcolm Mitchell

Monetary Sovereignty

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption + Net exports

#MONETARY SOVEREIGNTY

2012-08-14 13:27:58

Source: