| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Public vs. private: The contradictory and misguided arguments

Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes..

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and the rest..

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

============================================================================================================================================================================================================================================================

In the September 3rd, 2013 post, “The private sector myth busted, then, oh no, the public sector myth repeated,” we mentioned Mariana Mazzucato, an economist and professor of science and technology policy at the University of Sussex, UK, and her then latest book, The Entrepreneurial State: Debunking public vs. private sector myths.

The book debunks the myth that the private sector is better at creativity and innovation than is the public sector — a myth often repeated by debt hawks to support their beliefs that the federal government, the federal deficit, and the federal debt all should be cut back.

More recently, TIME Magazine ran a short article, referencing Mazzucato’s findings:

Why Hillary Clinton Is Right About Pfizer

Rana Foroohar, Nov. 24, 2015Three cheers for Hillary Clinton and other politicians who are decrying Pfizer’s tax “inversion” deal that would allow it to take over an Irish pharma company and relocate there, thus saving $21 billion in American taxes.

One of the many reasons tax inversion deals—merger are so egregious is that the very firms that are most able to do them have also been the biggest beneficiaries of government help.

Pfizer and other such firms will argue that they need to pay lower taxes to fund the research that results in miracle drugs. But that is a myth.

We credit the private sector for the innovation and growth in our economy. But a number of academics and policy thinkers, including University of Sussex economist Mariana Mazzucato, argue powerfully that it is the government (and thus taxpayers) rather than the private sector that deserves the credit for such innovation.

Here is where the confusion sets in:

The U.S. government is Monetarily Sovereign, which means it neither relies on, nor uses, tax dollars to fund spending. It creates dollars, ad hoc, by spending.

Even if all federal taxes fell to $0, the federal government could continue spending, forever. Taxpayers have nothing to do with federal spending.

“Every major technological change in recent years traces most of its funding back to the state,” says Mazzucato, who backs the claim up with powerful statistics and anecdotes in her book.

Most parts of the smartphone that make it smart – GPS, touchscreens, the Internet–were advanced by the Defense Department.

Tesla’s batteries came out of a Department of Energy grant. Google’s search algorithm was boosted by a National Science Foundation innovation.

Likewise, many new drugs that have made big money for firms like Pfizer have come out of NIH research.

The National Institutes of Health have spent almost a trillion dollars since its founding on the research that created both the pharmaceutical and the biotech sectors — with venture capitalists only entering biotech once the red carpet was laid down in the 1980s.

The fact that the federal government has originated many of our great technical advances does not translate into, “Companies should pay more taxes.” It’s a false, confused argument.

Companies invest billions in research and development. Paying taxes reduces their ability to invest.

Since the federal government has no need for tax dollars, and taxpayers do not pay for federal spending, there is no economic advantage to taking money from corporations and giving it to the federal government.

So why the mythology that the private sector deserves all the profits and the credit for innovation? Because there are huge profits to be made with that narrative.

No, the reason is: The federal government doesn’t need or use the money, and taking dollars from the private sector reduces economic growth.

The author seems to have some strange “fairness” issue, as in: “It isn’t fair that the government invests all that money and the private sector gets the credit and the profits.”

But that is exactly what Monetarily Sovereign governments are supposed to do. That is why they are allowed to have control over our money. It’s the fundamental purpose of Monetary Sovereignty.

It was the National Venture Capital industry that in 1976 convinced the government to reduce capital gains tax by 50% in only five years.

Likewise, says Mazzucato, “It is Big Pharma that is able to charge exorbitant prices in the name of recouping their high innovation costs—and also lobby for massive tax reductions related to patents that have no effect on their investments.”

There are better models. The U.S. government in the past has dictated that companies reinvest money in Main Street rather than give it to Wall Street.

That’s how Bell Labs was born, after the federal government pressured AT&T to reinvest profits in innovation. We got the C++ programming language and cell-phone calling technology, among many other advances, out of that. Not a bad precedent.

Or better yet, the federal government could invest money in Main Street via bigger social benefits (better Social Security, Medicare for all, Medicaid, school lunches, food stamps, free college, etc. — The Ten Steps to Prosperity (see below) — rather than trying to micromanage the activities of private companies.

The NIH invests $30 billion per year in research that enriches companies like Pfizer. Meanwhile, Big Pharma spends more on marketing than R&D, and is the leader, along with the tech and energy sectors, in share buybacks that make investors wealthy without creating any real growth or jobs.

Clinton and others should keep the pressure on Pfizer and other such firms—and the next president should make both buybacks and inversions, which cheat the true economic makers in this country, illegal.

No, Clinton should keep the pressure on the federal government to use its unlimited resources to grow the economy and to improve the lot of our citizens.

As for share buybacks, they merely transfer dollars from one part of the economy to another; tax increases remove dollars from the economy.

It is federal taxes, not share buybacks, that “cheat the true economic makers in this country,” the public.

Unfortunately, it’s not just Professor Mazzucato who seems to believe that taking dollars from the private sector helps grow the economy.

LOWERING THE MARGINAL CORPORATE TAX RATE: WHY THE DEBATE?

Nikolay Anguelov, Ph.D., Assistant Professor of Public Policy, Department of Public Policy, University of Massachusetts Dartmouth

© 2015 by Nikolay AnguelovIn light of the politically charged debate in America on the unethical and unpatriotic behavior of Multinational Corporations (MNCs) that engage in tax inversion, this study concludes that relatively high corporate taxes are not the culprit. In fact, they contribute to GDP growth.

Professor devotes many statistics to his belief that in some mysterious — impossible — way, high corporate taxes contribute to GDP growth. (Perhaps this is the time to quote the old phrase: “There are three kinds of lies: lies, damned lies, and statistics.” )

Seemingly, the good Professor does not know the formula for GDP, which is: GDP = Federal Spending + Non-federal Spending + Net Exports.

How high corporate taxes increase any element of the GDP formula never is explained.

The detriment lies in a system of stimulating economic activity through providing incentives to write off firm debt.

In the United States this policy direction of ever increasing measures to deduct taxes from operational expenses has created a reality in which most firms pay no taxes at all, so that the federal government only collects 9% of its total tax revenue from corporate taxes. This fact renders the debate moot.

The Professor also does not explain why higher firm debt is economically desirable, nor does he explain why cutting non-corporate taxes wouldn’t be preferable to increasing corporate taxes. Are Americans taxed too little?

Reversing such a legacy would be impossible because a whole industry has developed around it of lawyers, accountants, finance managers, and organized groups that represent their interests.

He doesn’t realize he has given an important reason for lowering tax rates. The lower the rates, the less need for expensive lawyers, accountants et al.

The results of this study stress the need for understanding the financial maneuvering of MNCs in managing their debt burden for maximum tax benefits.

MNCs face two incentives in debt management – one is to show high levels of debt when writing off taxes, the other is to show profitability to their shareholders, i.e. – low debt. The winning balance varies based on MNC, nation of incorporation, and how value is presented to shareholders.

Again, the Professor completely misses the point. The ultimate corporate goal is profitability, both for investment (in goods, services and workers) and for shareholder return. A corporation would be remiss in not trying to achieve that goal, partly by cutting taxes.

The bottom line: Taxes reduce corporate profitability. The federal government neither needs nor uses tax dollars. It has the unlimited ability to create dollars for economic stimulation, which it does ad hoc, by spending.

The federal government has been responsible for many scientific advances, and the reason is clear: Innovation requires money, and private money is less willing and less able to take big risks and wait long times for uncertain results.

The notions that corporations should pay more taxes and that the federal government is too large, not only are contradictory but misguided.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

THE RECESSION CLOCK

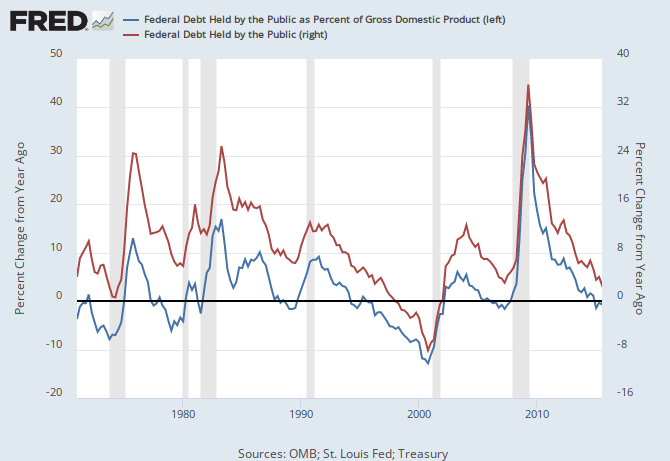

Recessions begin an average of 2 years after the blue line first dips below zero. There was a dip in 2015. Recessions are cured by a rising red line.

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

Source: http://mythfighter.com/2016/01/07/public-vs-private-the-contradictory-and-misguided-arguments/