| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Spreading Insolvency Around Does Not Create Solvency

Charles Hugh Smith / OfTwoMinds.com

I recently received a brief but powerful summary of the global financial system’s intrinsic instability and unsustainability from correspondent Ray W., author of A Change in the Weather.

One key point is that spreading insolvency (debts that will never be paid back, debt based on totally phantom assets) over a populace does not somehow conjure up a solvent financial system or State. Distributing insolvency only destroys the last remaining islands of solvency in a bankrupt world.

The entire global financial “recovery” engineered by central banks and Central Planning is based on the absurd notion that if we spread unpayable debt over the entire body politic (be it a nation or regional entity such as the European Union) then that distribution will somehow make the debt payable and the phantom assets real.

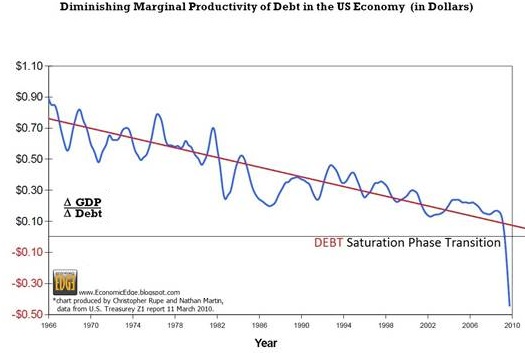

The debt remains unpayable and the assets (collateral) remain stubbornly phantom.As for adding more debt (selling Eurobonds, Treasury bonds, etc.), please note the diminishing return on additional debt: it is now negative.

Here is Ray’s commentary:

Not only the US Federal Reserve, but the EU collectively and its members individually are blowing another bubble with artificially suppressed interest rates inducing a flight to equities. It may not look like a bubble because values are climbing so slowly and uncertainly, but that is just an indicator of the structural weakness and exhaustion of petrocapitalism. In terms of thermodynamics, the engine is just too big to run on the same fuel without serious retooling.

The debt from the past three decades of bubbles–finance, dot-com, real estate–is still largely unrepaid, and won’t be. Whether nefariously intended are not, the current payback scheme, focused as it is on sanctity of contract, is to keep the bond holders from absorbing any of the losses (the Greek haircut notwithstanding). Modern economics is all about trust, so if contracts are no longer reliable, then the whole system–which depends 100% on credit–functions much less efficiently and much more expensively. It begins to look medieval.

The hope is that the states can titrate these losses into the general population, where they will be diluted and absorbed like pollution. But like climate change, we’ve simply reached the saturation point. The world can no longer be a sump, economic or atmospheric.

Thank you, Ray. Diminishing returns define the flailing financial system: the return on petrocapitalism is declining (how many barrels of oil or equivalent does it take to extract and process one barrel of shale-derived oil?), the return on more debt has turned negative, the yield on “saving” bankrupt States is marginal, and so on: spreading insolvency to the taxpayers does not magically create solvency, it only distributes insolvency to every nook and cranny of the economy.

All the debt remains painfully real; it is only the collateral that is illusory.