| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

The Decline In Living Standards

Do not be lulled by the siren call of inflation – The slow decline in living standards. Gas is up 100 percent over last 8 years while income has fallen.

Inflation has a slow methodical way of eroding the purchasing power of what sits in your bank account. The Federal Reserve is doing all it can to create asset inflation to allow banks to offload inflated assets onto the market so they can repent for the financial sins created during the credit bubble. Unfortunately there are unintended consequences for this. The first consequence is the fact that most Americans have seen their income drop in the last decade. So even if prices stayed the same, their purchasing power has fallen. Yet prices in many key items have actually gone up. By going into full debt mode, the Fed is trying to weaken the US dollar and because of this, the price of goods sold on global markets has gone up. The end result is that many working and middle class Americans find that they are purchasing less for more.

The cost of filling up the car

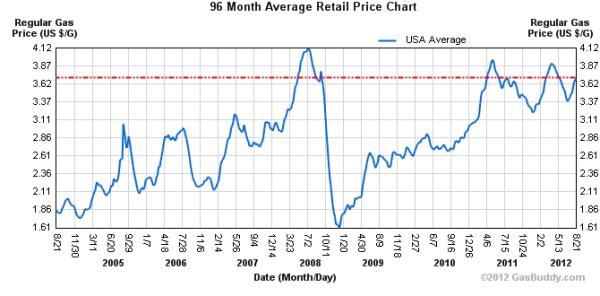

Some seem to think that the oil bubble somehow popped and has moved on. That is not the case. Demand for fossil fuels remains strong and thanks to a weak US dollar, the price of gas is still high:

The cost of one gallon of gas is up over 100 percent from only eight years ago. Has the typical household income gone up by 100 percent in this time? Of course not. In fact,household incomes have fallen. Since the recession hit, the typical American has seen their net worth crushed by nearly 40 percent. With our commuting and auto based culture, having gas go up by 100 percent is definitely going to leave a dent in your wallet. Yet some still want to deny that there is no purchasing power loss in the US.

Do you eat?

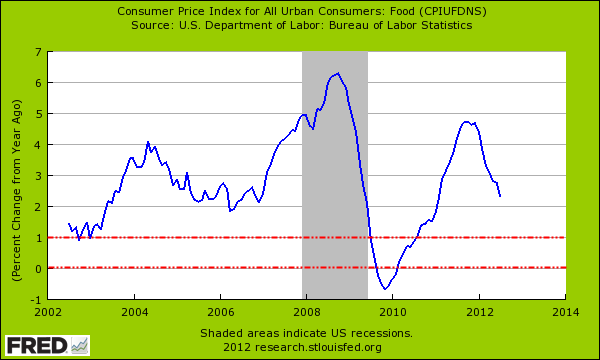

The price of food has also gone up:

Over the last decade the price of food has far outpaced the growth in income (which actually fell). At the height of the recession the cost of food was rising at a 6 percent annual rate. That is completely unsustainable. Even earlier this year the cost of food was rising at a 5 percent annual rate. This would be fine if household incomes were keeping in line but they have not. So two very key items in food and energy are certainly seeing the impact of inflationary pressures.

Read the rest at My Budget 360

2012-08-27 11:21:43

Source: http://www.fedupusa.org/2012/08/the-decline-in-living-standards/

Source: