| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

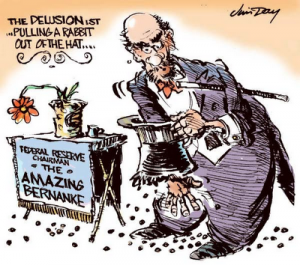

Why QE Is Not Working

Tyler Durden / ZeroHedge

Up until now we were a lone voice in the wilderness, with our “dry-humored” Transatlantic colleagues, working for a newspaper funded with Goldman Sachs advertisements, periodically mocking our “misunderstanding” of credit and money creation. We are now delighted that none other than one of the foremost opinions on all topics “shadow” stood up this week, and admitted that indeed, it is Zero Hedge whose view on money creation is the correct one. Behold several absolutely critical observations by Citi’s Matt King. The same Matt King who a week before the collapse of Lehman wrote “Are The Brokers Broken” and explained to all those who had heretofore been reading and basing their understanding of finance on the above-mentioned Transatlantic newspaper, why everything they know about the modern financial system is wrong. Lehman filed for bankruptcy 12 days later.

Since early 2010 Zero Hedge has said that for the Fed’s QE efforts to be successful in stimulating the economy, and rekindling inflation, it has to focus on not only stimulating traditional bank liabilities but far more importantly offsetting the collapse in shadow bank liabilities. As we observed in July, when the latest Z.1. update was made available, there is still a nearly $4 trillion hole that has to be be plugged on a condolidated basis from the all time “credit money” high of $33 trillion in 2008. Until such time as the Fed’s largesse pumps enough to fill this void, the US economy will be mired in deflation.

To wit:

“What is worse is that even when accounting for offsetting traditional bank liabilities, on a consolidated basis, the US total financial sector is still an epic $3.8 trillion below its all time highs, just above $33 trillion. Unless and until this $3.8 trillion hole is plugged, one thing is certain: risk is not going anywhere (also notable is that consolidated liabilities in Q1 declined by $86.2 billion at a time when the Fed was engaged in Twist but that is for Ben Bernanke to worry about, not us).”

In fact, the misconception is so bad, that even the Fed’s own John Williams recently confirmed the Fed itself has no idea how money creation in the New Normal, where the bulk of “credit money” exists in shadow aggregates, actually works. We explained this in “Fed’s John Williams Opens Mouth, Proves He Has No Clue About Modern Money Creation”

The Problem (How Large Will The Losses Be – and can the reaction be contained?):

continue at ZeroHedge:

http://www.zerohedge.com/news/why-qe-not-working

Fair Use Notice: This post contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are makingsuch material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any suchcopyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest inreceiving the included information for research and educational purposes. For more information go to: www.law.cornell.edu/uscode/17/107.shtml.If you wish to use copyrighted material from this site for purposes of your own that gobeyond ‘fair use’, you must obtain permission from the copyright owner.