| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Where Risk Taking Really Hurts

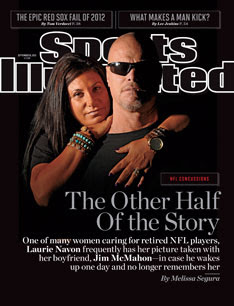

Sports Illustrated has a cover story on dementia and NFL players. They mention Ray Easterling, played for 8 years in the 1970s. They note:

Ray, who’d had a successful career in financial services, began making impulsive and risky decisions, a hallmark, some scientists say, of chronic traumatic encephalopathy…

If risk were positively related to return, one effect of this would be for many very wealthy people to be morons who took more risk than they realized. Sure, many would fail, but there should be vast riches to those who succeed. Indeed, in De Long, Shleifer, Summers, and Waldmann (1990), this is indeed the implication: wealth becomes concentrated among deluded investors who took excessive risk.

This clearly does not describe wealthy investors. Many successful investors are lucky, and many aren’t extremely bright. But very few of them are stupid, that is, have dementia or an IQ below 85. This is just another datapoint supporting my argument that risk is not positively related to return. Risk taking without intelligence is a sure path to financial disaster. If it were all factor loadings derived from covariances, it would be too easy.

2012-09-09 20:17:40

Source: http://falkenblog.blogspot.com/2012/09/where-risk-taking-really-hurts.html

Source: