| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

The Sound of Rumbling From the Student Debt Bubble

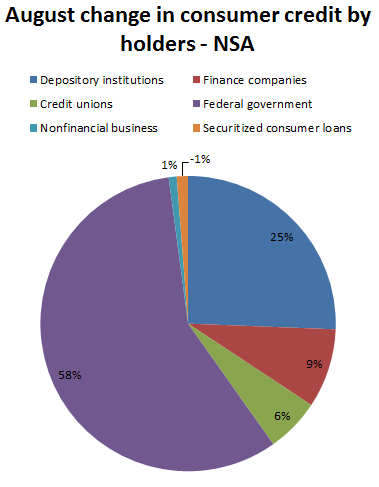

Jump in consumer credit last month came mostly from student debt growth. For two decades student debt expanded at a rate above 17 percent per year.

from My Budget 360

The flashing alert signs permeating from the higher education bubble should give people pause to the next flavor of the day bubble. This month information was released regarding consumer credit growth. Most of the headlines took this as positive economic news but digging deeper into the data we realize that the bulk of the growth came courtesy of exploding student debt. Even with the encyclopedia amount of data showing how horribly run many for-profit colleges are run, the government continues to back these risky endeavors while saddling young Americans with unrelenting levels of debt. It doesn’t take a rocket scientist to see the predatory nature of these operations just like it was easy to see subprime loans were going to end badly. So why continue to allow this to go on? Why is the system so adamant on continuing to pour layer upon layer of student debt syrup onto the younger segment of our nation that is already struggling in the employment market?

The flashing alert signs permeating from the higher education bubble should give people pause to the next flavor of the day bubble. This month information was released regarding consumer credit growth. Most of the headlines took this as positive economic news but digging deeper into the data we realize that the bulk of the growth came courtesy of exploding student debt. Even with the encyclopedia amount of data showing how horribly run many for-profit colleges are run, the government continues to back these risky endeavors while saddling young Americans with unrelenting levels of debt. It doesn’t take a rocket scientist to see the predatory nature of these operations just like it was easy to see subprime loans were going to end badly. So why continue to allow this to go on? Why is the system so adamant on continuing to pour layer upon layer of student debt syrup onto the younger segment of our nation that is already struggling in the employment market?

Continue Reading at MyBudget360.com…

2012-10-10 03:02:55

Source: http://financialsurvivalnetwork.com/2012/10/the-sound-of-rumbling-from-the-student-debt-bubble/

Source: