(Before It's News)

There many myths about Fed policy over the past few years, but the biggest one has to be that the Fed has been monetizing the national debt. This simply is not true, but it does not stop some folks from making this claim. For example, at last week’s Cato Monetary Conference we find former Fed officials

pounding the Fed-is-monetizing-the-debt drums:

Mr Warsh and Mr Poole (who was filling in for Allan Meltzer) made a sharp distinction between the “legitimate” efforts to fight the crisis and the subsequent easing actions that were, allegedly, unjustified by the economic fundamentals. According to them, the interventions of 2007-2009 were required to ensure that “the markets could clear”, as Mr Warsh put it, while the second round of easing was done to satisfy “political masters” by monetising the debt. In fact, Mr Warsh said that the Fed was being actively unhelpful by “crowding in” Congress’s supposedly poor policy choices.

My first response is how can they can say this with historically-low

U.S. treasury yields and muted

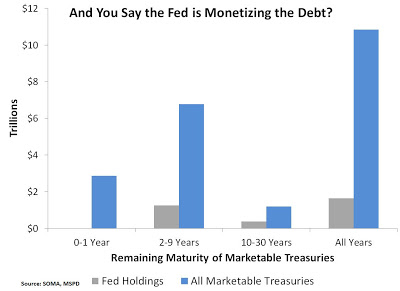

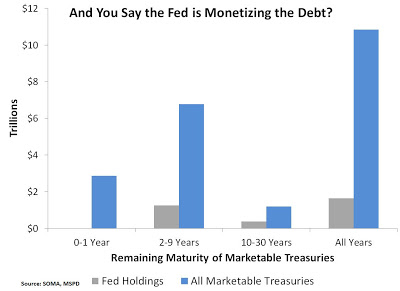

inflation expectations? Surely, if the Fed were truly monetizing the debt we would be seeing a 1970s-repeat in the bond market, but we are not. And this is happening, in part, because the Fed is not that big of a treasury purchaser. Consider the figure below. It shows the Fed’s stock of treasuries by remaining maturity compared to the total stock of marketable treasuries as of the end of October, 2012. Though the Fed’s share of treasuries increases by remaining maturity, at most it hits 32% of the total for 10-30 years category. That means that after many months of Operation Twist that roughly 68% of long-term treasuries are still held outside the Fed. Overall, the Fed holds about 15% of marketable treasuries as seen in the “All Years” category. It is hard to square these numbers with the allegations that the Fed is monetizing the debt.

Some commentators like to focus on the change in treasury holdings in 2011 because it sounds so scary. Here is Arnold Kling:

In 2011, the Federal Reserve bought 77 percent of new debt issued by our government. We are already resorting to inflationary finance.

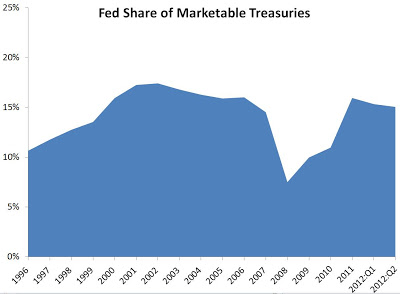

While the Fed did purchase a large share of new treasuries in 2011, these purchases only returned the Fed’s share of total marketable treasuries to its pre-crisis level as seen below. Again, not exactly a picture of debt monetization.

So stop accusing the Fed of monetizing the debt and enabling the large budget deficits. And stop blaming the Fed for the

long decline in treasury yields. If anything, blame the Fed for allowing treasury interest rates to

fall, but that is a

different story.

Source: