| Online: | |

| Visits: | |

| Stories: |

The Shackles of Consumer Credit in a Low Rate Environment

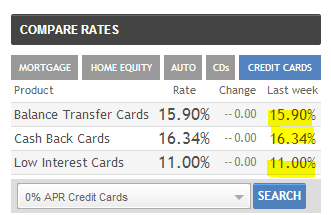

Banks would rather leverage low rates from the Fed than lend money to cash strapped American households. 15 percent average rate on credit cards and typical savings account rate near 0 percent.

from My Budget 360

In a world where debt equals the ability to purchase large items, access to debt is king. For this reason banks are the new modern day oligarchy since they have a nearly unlimited line of credit with the Federal Reserve. The public during the credit bubble days had access to nearly unlimited debt via mortgages, home equity loans, auto debt, credit card debt, and student debt. Since the credit bubble burst, access to credit has been severely limited to the public. It is interesting to note that credit card debt, the lubricant of our consumer economy is lower today than it was in 2009. Some $56 billion has been taken away from the credit card market for American consumers. Banks have the ability to loan but choose to speculate in real estate investments since many households simply do not have the incomes to back up large purchases. Part of being addicted to debt is that the withdrawal is painful yet banks have not faced any retrenchment while the public has been forced to adapt to credit austerity.

In a world where debt equals the ability to purchase large items, access to debt is king. For this reason banks are the new modern day oligarchy since they have a nearly unlimited line of credit with the Federal Reserve. The public during the credit bubble days had access to nearly unlimited debt via mortgages, home equity loans, auto debt, credit card debt, and student debt. Since the credit bubble burst, access to credit has been severely limited to the public. It is interesting to note that credit card debt, the lubricant of our consumer economy is lower today than it was in 2009. Some $56 billion has been taken away from the credit card market for American consumers. Banks have the ability to loan but choose to speculate in real estate investments since many households simply do not have the incomes to back up large purchases. Part of being addicted to debt is that the withdrawal is painful yet banks have not faced any retrenchment while the public has been forced to adapt to credit austerity.

Continue Reading at MyBudget360.com…

Source: http://financialsurvivalnetwork.com/2014/02/the-shackles-of-consumer-credit-in-a-low-rate-environment/?utm_source=rss&utm_medium=rss&utm_campaign=the-shackles-of-consumer-credit-in-a-low-rate-environment