| Online: | |

| Visits: | |

| Stories: |

Why the Next Acceleration in Price Inflation Could Be Very Near

from The Economic Policy Journal:

EPJ Daily Alert subscribers know that I have a love-hate relationship with the MIT Billion Prices Index.

EPJ Daily Alert subscribers know that I have a love-hate relationship with the MIT Billion Prices Index.

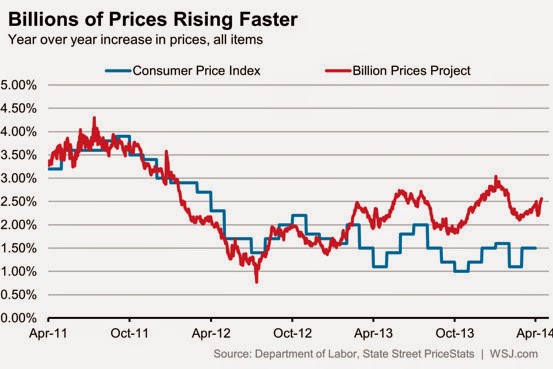

I believe that in many ways it is a much superior measure of overall price inflation in the economy than data put out by the Bureau of Labor Statistics. However, a very odd up and down move in the index caused me, in the ALERT, to question its reliability. I just didn’t buy that prices were jumping up and down as much as the Index was indicating. In the chart below, notice the up and down movement in the last quarter.

In the February 19 ALERT, I wrote:

The MIT Billion Prices Index is becoming very volatile. From a annualized inflation rate of over 4.0% just weeks ago to a current rate of 1.36%. This is an indication that something is distorting the number. I am still keeping an eye on the index, but its recent volatility suggests to me that it is yet one more failed econometric data collection attempt.