| Online: | |

| Visits: | |

| Stories: |

Worldwide Derivatives Ready to IMPLODE!

Unfortunately, starting in mid-2014, it did in a big way.

Here is a chart of the inverted US Dollar (meaning when the Dollar rallies, the black line falls) and commodities (the blue line). Note that the commodity collapse tracked the US Dollar rally almost tick-for-tick.

$234 Trillion of these derivatives are held by 4 major banks in the US.

Earlier this month, it was revealed that the banks now have the power to confiscate depositors’ money in times of financial crisis. And not just money that’s over the FDIC limit, but everything you have in the bank, as the FDIC is woefully underfunded to cover depositors’ losses of any amount.

The 4 Banks with the Biggest Derivatives Exposure

These are the most dangerous banks that will be the first to fall, and the first to claim their depositors’ money:

- JP Morgan Chase Bank

- Citibank National

- Goldman Sachs Bank USA

- Bank of America

Find Out Which Bank is the Most Vulnerable, Holding $70 Trillion in Derivatives

Read the rest of the story at GramsGold.com

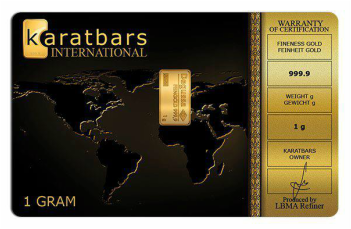

If you can’t afford to buy gold bullion at over $1,000 an ounce, consider buying it by the gram. It’s affordable. And you also have the option of an affiliate plan that allows you to make a good residual income, if someone you knows buys it. Click here for more information.

Let it rip.

And twenty percent of these derivatives are based on fracking for all, what could possibly go wrong? I suppose if the price of oil plummeted, that could be bad for derivatives.

“for oil” dummy

So can start converting your cash into bitcoin.