| Online: | |

| Visits: | |

| Stories: |

Has The Global Run On PHYSICAL Silver Begun? Shortages On The Horizon?

by Steve St. Angelo, SRS Rocco:

The situation in the silver market seems to point to the beginning stages of a GLOBAL RUN ON SILVER. I say, “it seems to point to a RUN on silver” due to several indicators I am looking at. This also may force the global silver market to suffer shortages in the future. Why? Well, let’s take a look at these different indicators.

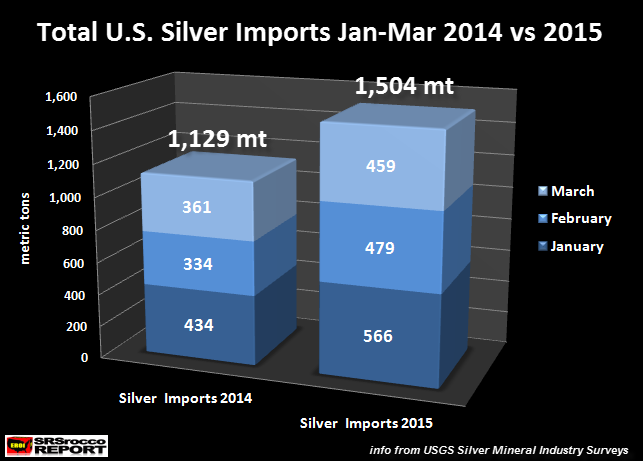

First, I recently wrote an article Why Is The U.S. Importing So Much Silver Bullion?, showing that U.S. silver imports picked up considerably in the first two months of the year. Well, this continued into March as total U.S. silver imports reached a hefty 1,504 metric tons (mt) compared to 1,129 mt during the same period last year:

U.S. silver imports are 33% higher than the first quarter of 2014. If we consider industrial silver demand, Silver Eagle sales and the Comex Silver Inventories, the U.S. Silver Market did not require an additional 375 mt of silver.

Industrial silver demand was probably lower due to a falling U.S. Q1 GDP. Silver Eagle sales were actually less the first quarter of 2015 compared to 2014 and total Comex silver inventories didn’t change all that much.

So, what gives? If the U.S. Silver Market needs less silver than it did during the first quarter of 2014, someone must be stockpiling silver. There has been speculation that JP Morgan may be one of the big buyers. If they are, they are buying bullion bars and not Silver Eagles or Maples. Furthermore, I do believe there are hedge funds and individuals coming in and buying huge amounts of Silver Eagles. This is probably due to the increased financial turmoil stemming from the Greek situation.

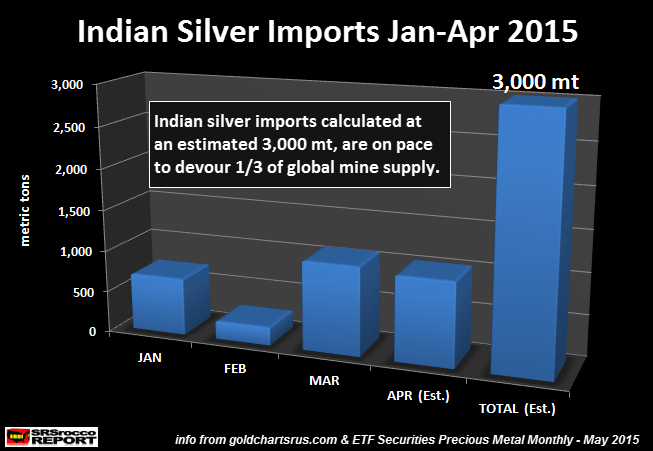

Secondly, India is importing the MOST SILVER EVER. As I mentioned in another article, INDIAN SILVER IMPORTS: On Track To Smash All Records, India imported a massive 3,000 mt in the first four months of the year. If this trend continues, India will import a whopping 9,000 mt in 2015, surpassing its previous record of 7,000 mt in 2014.

I would imagine if the world suffers a financial contagion resulting from the Greek “NO” vote, we could see Indian silver bullion imports pick up even more in the second half of the year. This could cause more stress on already tight silver market.

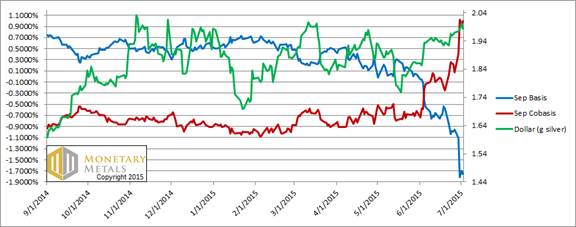

Third, evidence points to a possible tightness in the physical silver market. In Keith Weiner’s recent article, Silver Market Change Report July 5, 2015, he published the following chart on the Silver Cobasis:

Keith stated the following about the new change in the silver cobasis:

…. However, look at that red cobasis line go. It was a mere 7 basis points last Friday. It ended this week at 100 bps. The cobasis of farther-out contracts also rose proportionally.

Suddenly, the silver market is firm.

We can name two reasons why the cobasis might skyrocket. One is that there is a risk. If your counterparty defaults, then you don’t get your metal back. You may get dollars. The exchange will insist the dollars are equivalent to the metal, but that’s small consolation.

We do not believe this is the main problem now, because it’s not occurring in gold. If the banks were in imminent danger, the gold basis would not be quiescent.

The other possible reason is that there’s a growing shortage of silver. Of course, in order to decarry silver, you have to have the metal. If it’s not available, you can just wistfully watch the rising cobasis.

Basically, Keith believes the rising cobasis (in RED) is a result of a tightness in the silver market. He goes on to say this is the present condition, but that could change in the future.

Well, I don’t see conditions in the Global Financial Arena getting any better going forward. I believe hedge funds and individual buyers are finally figuring out the market is getting OUT-OF-HAND and are placing wise bets by purchasing physical silver. This can be seen in the huge increase in Silver Eagle buying.

Fourth, the recent surge in Silver (and Gold) Eagle buying. If we look at the recent update put out by the U.S. Mint, we can see that sales of Silver Eagles spiked in June and continue to be strong in July: