| Online: | |

| Visits: | |

| Stories: |

IMF Euro Area Report: The Sick Land of Banking

by Constantin Gurdgiev

David Stockman’s Contra Corner

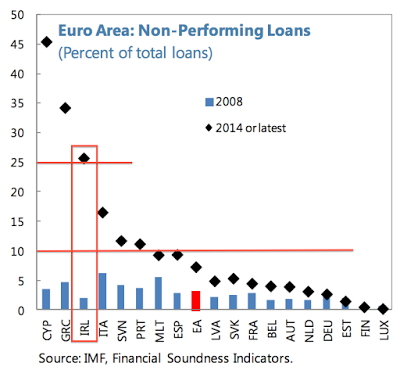

The IMF today released its Article IV assessment of the Euro area, so as usual, I will be blogging on the issues raised in the latest report throughout the day. The first post looked at debt overhang.So here, let’s take a look at IMF analysis of the Non-Performing Loans on Euro area banks’ balance sheets.A handy chart to start with:

[...] The above gives pretty good comparatives in terms of the NPLs on banks balance sheets across the euro area. Per IMF: “High NPLs are hindering lending and the recovery. By weakening bank profitability and tying up capital, NPLs constrain banks’ ability to lend and limit the effectiveness of monetary policy. In general, countries with high NPLs have shown the weakest recovery in credit.”

Continue Reading at DavidStockmansContraCorner.com…

Source: http://financialsurvivalnetwork.com/2015/07/imf-euro-area-report-the-sick-land-of-banking/?utm_source=rss&utm_medium=rss&utm_campaign=imf-euro-area-report-the-sick-land-of-banking