| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

What Goes Down Must Come Up

Tuesday, November 29, 2016 22:03

% of readers think this story is Fact. Add your two cents.

The Mercatus Center is running a colloquium on the low interest rate environment and its implications for the economy. The colloquium runs twelve days and each day a new essay will be published. Since this is leading up to the holidays, some are calling it the “twelve days of interest”.

Today the colloquium ran my essay in which I make the case that the 10-year treasury interest rate will return to the range of 4.0 to 4.5 percent. This definitely goes against the conventional view that the natural interest rate or “r-star” has permanently fallen and will keep treasury yields depressed. This view is evident, for example, in the FOMC’s summary of economic projections (SEP) where members expect the long-run value of the federal funds rate to land near 3 percent. So why my contrarian claim?

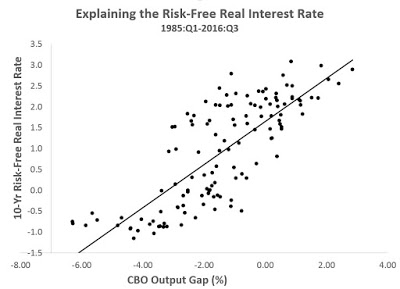

My answer, as laid out in the piece, is that much of decline in the 10-year real interest rate is due to a temporary decline in the natural interest rate. In my view, this decline is tied to business cycle forces rather than structural ones. As evidence for my view, I provide Figure 5 which shows a strong relationship between the natural interest rate–the 10-year, risk-free, real interest rate in the article–and the CBO’s output gap. Here is the same data plotted in a scatter plot:

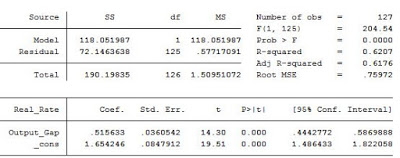

And here is the output from running a regression on these two series:

As I note in the piece, these results imply that if the output gap eventually closes (i.e. goes to zero) the natural interest rate will hit 1.65 percent. Add in 2 percent for inflation and a modest amount for the term premium and one easily breaks the 4.0 percent barrier.

I may be proved wrong, but the early bounce from the Trump shock is pushing in my direction. To be upfront, though, I was making a similar argument in 2014 when the economy early on appeared to be taking off. I still think my call was reasonable given robust growth in early 2014, but the growth quickly got snuffed out. It did so, in my view, because the Fed began talking up interest rate hikes and effectively tightening policy in mid-2014. Throw in some strains on the term premium from problems in China, Eurozone, new regulatory burdens and you get the low treasury yields since 2014. This seems to be changing now with the Trump shock but we will have to wait to know for sure.

I encourage you to keep following the colloquium. Other contributors, often with less sanguine views about future interest rates, will follow. The next one, for example, is from Joe Gagnon who does not share my outlook on interest rates. Also, the other pieces that follow will get more into the implications of the low interest rate environment. So stay tuned!

Source: http://macromarketmusings.blogspot.com/2016/11/what-goes-down-must-come-up.html