| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Fear Is Coming

Wednesday, March 1, 2017 12:28

% of readers think this story is Fact. Add your two cents.

Source: What Is That Whistling Sound

It is our view that the stock market is very streched and overvalued.

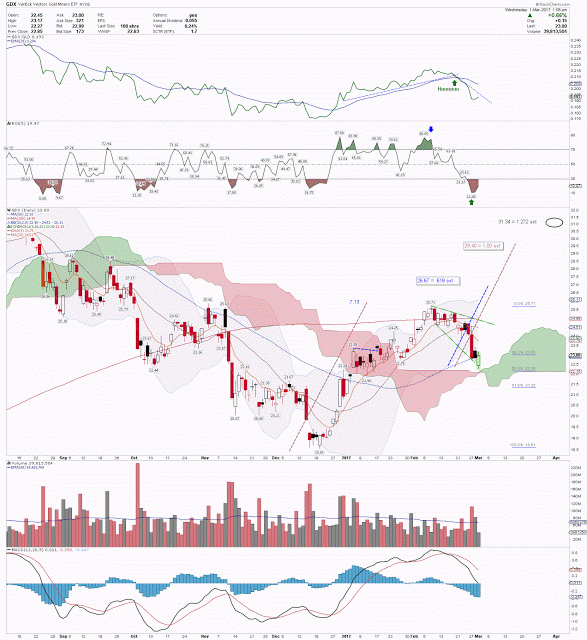

The fear gauge VIX, is now showing the early signs of wanting to ramp up.

A key crossover has now been met as the 13 ema has crossed the 34 ema. Many times historically this preceeds a sell off in the market.

We also note that the gold miners ETF GDX has sold off from the highs a couple weeks ago and appears to be putting in a reversal candle today.

In our view this is a low risk area to buy gold stocks assuming fear rises and investors switch out of risk assets to risk havens.

We await the Snapchat IPO tomorrow to see if this could trigger our theory within the next couple of days.

Source: http://whatisthatwhistlingsound.blogspot.com/2017/03/fear-is-coming.html