| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

A Challenge to the Fed’s Normalization Plans: the IOER-Treasury Yield Spread

Over at U.S. News and World Report, I have a new article up on the next big challenge facing the Fed: normalizing its balance sheet. Some excerpts:

This path to monetary policy normalization…. may be fraught with surprises and setbacks. Not only must the Fed avoid getting ahead of the recovery with its interest rate hikes, but it must delicately navigate the shrinking of a balance sheet that has grown fourfold since 2008. This latter task may prove to be especially daunting since it puts the Fed in unchartered waters. Never before has the Fed had to shrink its balance sheet…

I go on to discuss some of the many challenges the Fed may face in attempting to shrink its balance sheet. One of them is dealing with the potential stresses caused by the new regulatory demands of the liquidity coverage ratio running up against the spread between IOER and treasury bills:

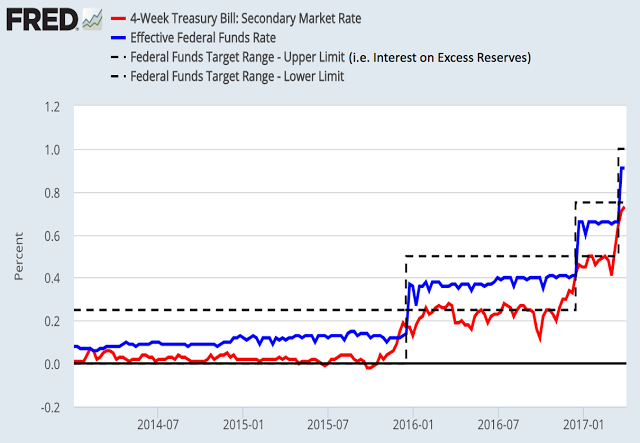

The second reason the scaling back of the Fed’s balance sheet may be challenging is that post-2008 regulation now requires banks to hold more liquid assets. Specifically, banks now have to hold enough high-quality liquid assets to withstand 30 days of cash outflow. This liquidity coverage ratio has increased demand for such assets of which bank reserves and treasury securities are considered the safest. So, in theory, as the Fed shrank its balance sheet, the banks could simply swap their excess reserves (that the Fed was pulling out of circulation) for treasury bills (that the Fed was putting into circulation). The challenge, as observed by George Selgin, is that the Fed’s interest on excess reserves has been higher than the interest rate on treasury bills. This creates relatively higher demand for bank reserves.

Banks would not want to give up the higher-earning bank reserves at the very moment the Fed was trying to pull them out of circulation. This tension could create an effective shortage of bank reserves and be disruptive to financial markets. The solution here would be for the Fed to lower the interest on excess reserves to the level of treasury bill interest rates.

Source: http://macromarketmusings.blogspot.com/2017/04/a-challenge-to-feds-normalization-plans.html