| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

The S&P 500 in Week 1 of April 2017

Sometimes, for the S&P 500, the more things stay the same, the more they change.

By staying the same, we're referring to the relative lack of change in the closing value of the S&P 500 on each trading day of the first week of April 2017.

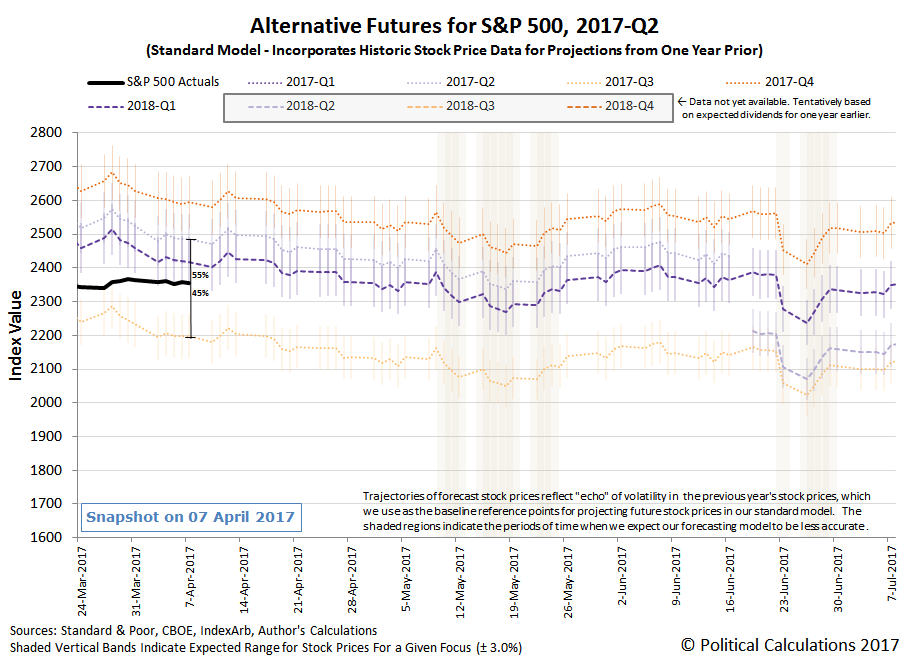

But over Week 1 of April 2017, we see a change in the future expectations that investors have. Specifically, investors would appear to have flipped the relative probabilities that they were assigning to the likelihood that the Fed will next hike interest rates in 2017-Q2 and 2017-Q2 from where they had set them a week earlier.

At that time, we estimated that they were giving a 55% chance of the Fed's next short term interest rate hike taking place in 2017-Q3 and a 45% chance that it would happen in 2017-Q2.

This week, thanks to the heavier weight of positive economic news that came out during the week, it appears that those relative probabilities have reversed to where investors are giving a 55% chance that the Fed will hike U.S. interest rates before the end of the quarter, and a 45% chance they'll hold off on doing so until the next quarter.

And all stock prices had to do to communicate that change in expectations was to mostly drift sideways to slightly lower as investors modestly reacted to the non-market moving news released throughout the week, where even the surprise U.S. bombing of Syria following reports of its government's use of chemical weapons in its civil war did little to roil the U.S. stock market.

That's not to say that other markets were not greatly affected by other news that came out during the week, but since we focus on the S&P 500, we have to play the cards that we've been dealt….

Speaking of which, here are the headlines that stood out from the pack for Week 1 of April 2017.

- Monday, 3 April 2017

-

- Debt load could snag students, hurt U.S. economy: Fed's Dudley

- Harker, joining chorus, says Fed could trim bond portfolio this year

- U.S. March auto sales indicate long boom cycle may be waning

- Wall Street down on weak auto sales, doubts about Trump agenda

- Tuesday, 4 April 2017

-

- Oil rises on signs of gradual tightening in global supply

- And so, the mighty fall: Fed's Lacker leaves central bank over leak of market-sensitive news

- Wall Street braces for rough ride as exchanges seek more speed bumps

- The exchanges are afraid of more flash crashes and other computer-aided market liquidity crises, but we wonder if they will end up paralyzing the market when it really needs to absorb or release unusually pent up energy, which could lead to even bigger problems than what they would have if they were to choose to accept the volatility instead….

- Wall St. flat as investors await China meeting, earnings season

- Wednesday, 5 April 2017

- Thursday, 6 April 2017

- Friday, 7 April 2017

-

- S&P futures down 0.5 percent, after U.S. strike in Syria

- Oil rises after U.S. missile strike in Syria, weekly gain 3 percent

- NY Fed's Dudley Q&A: Stresses Any Pause Would Be'Little Pause'

- Wall Street down after weak jobs, Fed comments, Syria airstrikes

Elsewhere, Barry Ritholtz categorizes the week's positives and negatives for the U.S. economy and markets.

Finally, on a programming note, since U.S. markets will be closed on Friday, 14 April 2017, so will we! Have a great, short week!

Source: http://politicalcalculations.blogspot.com/2017/04/the-s-500-in-week-1-of-april-2017.html