| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

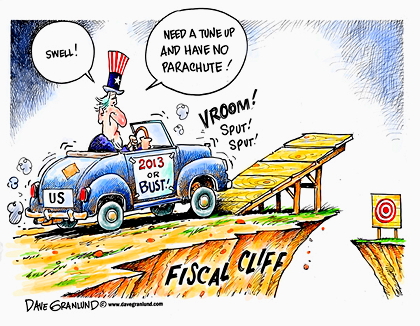

“Fiscal Cliffs, Then There Was This…”

by Chuck Butler

Folks, I love tax cuts just as much as anyone. And on the outside looking in, one would think immediately that we, as a country, can’t afford the tax cuts. But the debt has grown so much that abolishing the tax cuts is not going to be the elixir for what ails us. No, I’ve gone over this many times in the past, but at this point, we as a country have only three choices in dealing with our debt:

1. We can increase our revenue (raise taxes- it’s coming!)

2. We can reduce our expenditures (cut deficit spending- fat chance!)

3. We can allow the dollar to depreciate further and further to pay back debts with cheaper dollars (looks like the easiest thing to do- right?)

My call on this is that we’ll take what’s behind doors Nos. 1 and 3 and hope for the best! Sorry to be the bearer of the bad news, but don’t shoot the messenger! It’s not as though longtime readers are hearing this stuff for the first time. I’ve become a broken record talking about debts, deficit spending, what’s going to happen, etc. OH! And just because I said that allowing the dollar to depreciate further sounded like the easiest thing to do doesn’t mean that it’s not going to hurt! Our purchasing power will be reduced, which is just another tax, in my way of thinking!

This morning, I saw a report on unemployment here in the U.S. that said that unemployment is up in 44 of the 50 states. That’s not a good thing for the economy, and it’s stuff like this that really makes the collar around the Fed heads’ necks become very tight. But at least Pfennig readers won’t be surprised if the backside of the financial storm that hit us in 2008 reaches our shores, for I’ve been warning you all about this for months now.

Then there was this, from Der Spiegel: “The severe drought in the U.S. has been blamed the rising prices of agricultural commodities. But that is only part of the story: Biofuels, financial speculation and changing dietary habits are also playing a role. The global food supply faces pressure from all sides. The American Midwest is experiencing its worst drought since the 1930s. One-sixth of the corn crop has been lost, and the soybean plants and wheat stalks don’t look much better. Shortages and rising prices for essential commodities are the result.

․

When they are writing about the drought in the Midwest over in Germany, you can bet the world sees this as a major problem. To recap: The FOMC meeting minutes sent the dollar for a ride on the slippery slope yesterday afternoon. Gold, euros and oil all saw huge jumps in their respective levels as the Fed heads signaled that if the economy doesn’t show some very good strength, they are prepared to implement additional accommodation “fairly soon.” Of course, the downside risk of these moves higher against the dollar is that the Fed heads drag their feet on this accommodation, not wanting to be seen as political.”

2012-08-23 15:22:46

Source: http://coyoteprime-runningcauseicantfly.blogspot.com/2012/08/fiscal-cliffs-then-there-was-this.html

Source: