| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Are oil prices a threat?

Read aguanomics http://www.aguanomics.com/ for the world’s best analysis of the politics and economics of water

Brian writes*

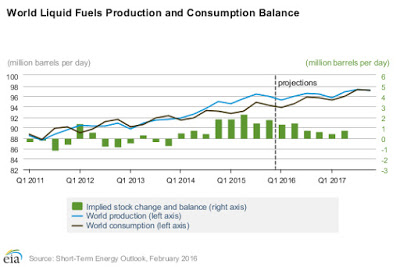

Oil prices have taken quite the tumble in the last 18 months. Falling about 75% from the $110 per barrel mark to $27. One might consider this to be highly beneficial from a consumer’s perspective. But, of-course the ripples of this oil shock are more far reaching then initial observation might communicate. It might seem as though the time has come for some oil producers to start “plugging their wells”. However, this would be to the detriment of the future rebound in oil prices. The benefits of which would go to those that have chosen to keep their oil production steadily flowing as long as they can cover costs.

The ripple effects of oil price drops can have lasting consequences on several levels. Firstly, it brings the possibility of political instability to already unstable parts of the world. Secondly, cheap oil makes it a very easily accessible source of energy. Exposing the world to more consumption and thus excretion of fossil fuels to the detriment of our increasingly suffering environment. Rendering an already threatening negative externality even more harmful as the spillover cost on society is ramped up. Thirdly, the steep drop in oil prices has caused a tumble in investment in the industry. Projects worth up to $380 billion have been put on hold. Countries such as Brazil are grappling with these effects because the oil industry is such a prominent component of the national economy. Saudi Arabia is also dealing with a increasingly threatening deficit.

The Main issue currently faced by the oil market is a production surplus in oil. The low prices are maintained by a production surplus, keeping the market over-flooded with oil. As this is happening, the consumption and production of oil rise to meet each other. In other words, the increased demand requires an increased supply. In order for the negative externalities, from dropping prices and increased oil consumption to be stemmed, the oil cartel OPEC must halt the oil shock. Something that they seem to be unwilling to do. If production is cut down, the prices can be stemmed. Hopefully halting economic strain. It is suspected that there is a possibility of political will behind this refusal. Primarily the drive of the United States and the Saudis to hurt the Iranian and Russian economies. In the process, the effects are globally felt and threaten different economic facets in a wide range of countries.

Bottom Line High oil production has decreased oil prices, causing a surplus that has a wide range of negative externalities on an international scale.

* Please comment on these posts from my microeconomics students, to help them with unclear analysis, other perspectives, data sources, etc.

Source: http://www.aguanomics.com/2016/02/are-oil-prices-threat.html