| Online: | |

| Visits: | |

| Stories: |

NY Times: Loads of Debt: A Global Ailment With Few Cures

NY Times: Loads of Debt: A Global Ailment With Few Cures

By PETER EAVIS

Beyond Greece and Puerto Rico, heavy borrowing is bogging down the economies of Brazil, Turkey, Italy and China.

In regard to the plague of both public and private debt, the headline of this Sulzbergerian bit of slime is right to describe the problem as a “global ailment”. But in the very next breath comes the big lie: “with few cures.” There are indeed cures to the perpetual debt virus; but because those fixes run counter to the Globalist agenda which the Slimes has faithfully pushed for more than 100 years, Sulzberger won’t tell you about them. Instead, readers are left to believe that perpetual debt and economic cycles are part of the natural course of things. From the article:

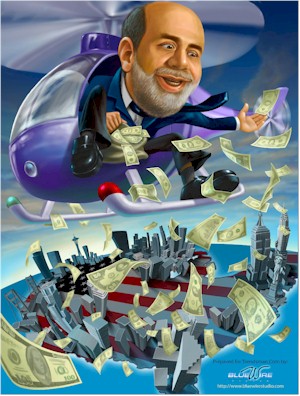

“There are some problems that not even $10 trillion can solve. That gargantuan sum of money is what central banks around the world have spent in recent years as they have tried to stimulate their economies and fight financial crises.”

From where did the “central banks around the world” get $10 Trillion to “spend”? Answer: From the magical printing press! Therein lies the problem – not the solution.

The economic propaganda (Keynesianism) continues:

“The tidal wave of cheap money has played a huge role in generating growth in many countries, cutting unemployment and preventing panic. But it has not been able to do away with days like Monday, when fear again coursed through global financial markets.”

“Monetary policy can only be a palliative,” said Diana Choyleva, chief economist at Lombard Street Research. “It cannot be a cure.”

At least this Choyleva lady understands that monetary policy (money printing) cannot cure the problem. But for her to even call it a “palliative”(temporary pain relief) is almost as stupid as calling it, “a cure”. The running of the printing presses is neither a “cure” nor a “palliative”. It is the root cause of destructive debt and bubble mania!

Ivy League Keynesians and other assorted eggheads of every stripe have this annoying little habit of complicating that which is actually very simple. “Intellectuals” view that trait as a form of sophistication. In reality; it is a form of insanity. Debt-based bubbles are very simple to understand; and thus, equally simple to cure. (Read: The Great Tomato Bubble)

The insane eggheads at Harvard & Oxford complicate that which is simple. The staff of TomatoBubble / Anti-New York Times simplifies that which appears complicated.

Step #1: Privately owned Central Banks (and the various subordinate local banks) inject all currency into the economy at interest. This can be accelerated by the easing of lending standards, the reduction of interest rates, the direct purchase of government bonds. and even the induced purchase of stocks by “preferred” brokers. These actions all involve the creation of money “out of thin air” and always result in a general price inflation and/or asset bubbles in real estate or stocks.

Step #2: Parallel to “monetary policy” is “fiscal policy”; which usually involves Governments spending (and borrowing) excessively in order to finance warfare and welfare operations. The shortfall (deficit) is partially covered by the sale of bonds to the Central Banks which print the money to buy the bonds.

Step #3: Because 100% of currency is injected into the system via private or public loans, all money supply is debt. Outstanding loan principal plus compound interest must therefore always be greater than the total money supply. Therefore, debt can never be paid back. In centuries past, this scam was called usury and was often banned.

Principal + Interest > Money Supply

Step #4: As bubbles develop and/or inflation increases; the money supply (lending) is tightened. A “liquidity crisis” develops as a growing number of borrowers, both public and private, must suddenly scramble to get their hands on enough new debt-money to repay old loans. As loans are paid back into the banking system, the money bubble deflates. Bankruptcies surge and markets crash as frightened depositors “run on the banks”. The eggheads refer to this as a “correction”.

Step #5: To “provide liquidity”, (“palliative”) Central Banksreturn to Step 1 and repeat the process! And on and on and on the madness of “economic cycles” and debt contagion continues decade after decade after decade.

It really is that simple! So then, what is the “cure”? That’s simple too.

Abolish the Central Bank and abolish all forms of consumer (not commercial) lending at interest. Apart from the sound commercial loans which will fuel future productivity and growth; issue debt-free currency from the Treasury in direct 1-1 proportion to annual productivity levels. New currency can be injected into the economy through a combination of useful public works projects, interest-free home loans and grants, and direct tax rebates.

Wealth may not be able to buy true happiness; but it can sure help to prevent unhappiness! Prosperity is available to all of us; but the Globalist-Marxist Central Bankers and their idiot minions won’t allow the masses of tax & debt slaves to have it.

Incomes would rise with zero inflation, zero personal & public debt, minimal taxation, and full employment. As a truly free economy takes off like a rocket, able-bodied working-age people can finally be weaned off of generational welfare dependency. The warfare state must also be gradually wound down to a truly “defensive” posture only. The resulting levels of debt-free permanent prosperity would dwarf even the American glory days of the 1950’s; and the need for government would fade back to a bare minimum – which is exactly why Sulzberger’s Commie Warmongering Times wants you to believe that there is “no cure”.

Oh if only the stressed-out, demoralized and distracted sheeple of the world knew what the wolves were doing to them; and what amazing prosperity and easy living that they are all missing out on!

Source: http://tapnewswire.com/2015/07/ny-times-loads-of-debt-a-global-ailment-with-few-cures/